South Dakota became a headline story for online business founders in 2025. A small state turned into a major player by keeping rules simple and costs low.

Entrepreneurs gained an edge with no tax on personal income or corporate earnings, plus a 4.2 percent sales tax that stayed among the lowest in the country.

The state moved paperwork online, cutting setup time to a fraction of what many other states require. Every step was designed to help business owners focus on growth instead of red tape.

The following sections will explain how taxes, costs, logistics, and community turned South Dakota into the best location for an e-commerce business in 2025.

Tax Rules that Changed the Game

South Dakota earned its reputation as a tax haven for entrepreneurs by keeping its system transparent and lean.

The state leaves more earnings in the hands of those who build businesses rather than those who file forms.

Highlights

- Personal income tax: None at all.

- Corporate income tax: None imposed.

- Base state sales tax: Fixed at 4.2 percent.

- Local add-ons: Usually range between 0.5 and 2 percent, keeping totals among the lowest in the nation.

Any business reaching 100,000 dollars in annual sales must register for sales tax collection.

The process is fully online and handled within days. Both physical and digital products fall under the same set of tax rules.

That way, business owners know exactly when to register and what to pay, without hidden thresholds or confusing exemptions.

Predictable rates, quick registration, and no income-based taxes create one of the most efficient systems in the United States.

Officials at the South Dakota Governor’s Office of Economic Development describe the state as open for opportunity, pointing to sound fiscal management, limited regulation, and a consistent record of supporting business growth across all sectors.

Fast Track to Register and Launch

South Dakota offers one of the quickest routes to form a legal business in the United States.

Every form and payment can be completed online, allowing founders to move from idea to full registration within a week.

Here are the steps to start a business in South Dakota.

1. Choose and Verify Your Business Name

Start by checking name availability in the Secretary of State’s database.

The chosen name must be unique and free of restricted terms. Reserving a name before filing can help secure brand identity early.

2. File the Articles of Organization

Submit the Articles of Organization online through the Secretary of State portal.

The filing fee equals 150 dollars for online submission. Include a registered agent with a South Dakota address.

Confirmation usually arrives within three to five business days, completing the legal formation of the LLC.

3. Obtain an Employer Identification Number

Request an EIN from the federal site immediately after state approval.

It serves as your company’s tax ID and enables you to open business bank accounts, sign vendor contracts, and process payroll under your legal entity.

4. Register for Sales Tax Collection

Once annual in-state sales reach 100,000 dollars, register with the Department of Revenue for sales tax collection.

The portal handles registration, filing, and payment without physical paperwork.

Both physical and digital products follow the same rules, making compliance straightforward.

5. File Annual Reports

Every South Dakota LLC must file an annual report costing $55 to maintain active status.

The form updates ownership and contact details, ensuring your company stays in good standing.

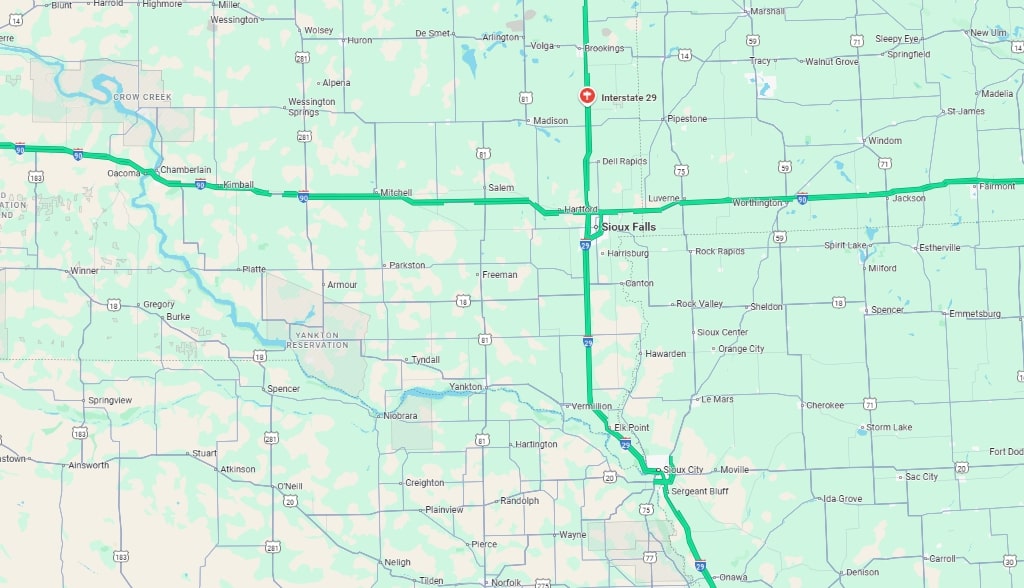

Business owners who manage physical stock can cut costs by securing local storage near major routes such as I-29 or I-90.

A small self-storage unit offers flexible space for inventory, seasonal goods, or shipping materials.

For example, business owners can review available options like Zionsville storage units for rent to compare pricing and accessibility before deciding on a location.

Sioux Falls Steps into the Spotlight

Sioux Falls became the center of e-commerce growth in South Dakota in 2025.

The city earned that role through location, workforce, and infrastructure that suit online retail and logistics.

Businesses here reach large markets faster and avoid the expenses found in major metros.

Location and Market Reach

Two interstate highways, I-29 and I-90, cross in Sioux Falls.

That single connection links the city to major hubs like Chicago, Minneapolis, and Denver.

Freight companies use those routes daily, which cuts delivery time and keeps fuel costs steady.

Local 3PL providers help smaller sellers store, label, and ship goods at competitive rates.

Workforce and Business Climate

A skilled workforce gives Sioux Falls stability.

Training programs at local colleges focus on logistics, supply management, and digital commerce.

Low unemployment and steady growth make it easy to hire staff with practical experience.

The local economy remains strong and balanced across retail, tech, and manufacturing, which reduces turnover pressure for new businesses.

Roads, Air Routes, and Smooth Shipping

As mentioned earlier, I-29 and I-90 meet in Sioux Falls and form the backbone of logistics.

Ask anyone moving freight through the region, and they will tell you the same thing: it is the most reliable corridor in the Midwest.

Truck drivers cover long stretches without gridlock, and delivery estimates stay accurate.

Air freight completes the picture.

Sioux Falls Regional Airport serves as a link between state commerce and national distribution.

Both FedEx and UPS operate major facilities nearby, so next-day delivery is a standard practice.

For e-commerce brands, consistency keeps everything steady. Orders go out on time, customers stay happy, and inventory stays in check.

Nathan Sanderson, executive director of the South Dakota Retailers Association, told South Dakota News Watch that the Wayfair court ruling in 2018 reshaped how online and in-store retailers compete. He explained that requiring e-commerce sellers to collect sales tax closed a 4.5 percent price gap that once favored online giants and helped local stores stay competitive.

The same report described how retailers across the state now combine online selling with in-person service to create a balanced model that keeps customers loyal.

High-Speed Internet Reaches Every Corner

Years of investment finally produced visible results. Broadband coverage now extends across most of the state, giving both urban and rural businesses the connection they need to manage online operations without interruption.

ConnectSD and BEAD programs financed large-scale fiber projects that reached areas previously left behind.

Local internet providers added new routes and upgraded equipment to support consistent service.

Many small towns now record average speeds above 100 Mbps, which supports cloud systems, online stores, and customer service platforms that used to be impossible outside the cities.

A small woodshop in a rural county can now handle online orders, post new product photos, and follow deliveries as easily as any company in Sioux Falls.

Many local sellers grew their reach once they had steady internet, turning what used to be just a small local store into active, competitive online businesses.

Cost of Running a Store in South Dakota

The figures remain lower than national averages, allowing smaller businesses to operate without extreme overhead pressure. Below are the main cost areas that shape real monthly budgets.

Rent and Warehouse Space

The average rent for industrial and warehouse space in Sioux Falls is around 7 to 8 dollars per square foot per year.

Many listings fall between 6.50 and 10.50 dollars, depending on location and facility size.

Leasing a 10,000 square foot warehouse at roughly 8 dollars per square foot equals about 80,000 dollars annually, or 6,600 dollars per month.

Labor and Payroll

Average hourly wages in the Sioux Falls area sit near 28 dollars for general roles.

Warehouse and fulfillment jobs average closer to 18 dollars per hour.

Two full-time employees at that rate cost around 7,200 dollars per month combined, or 86,000 dollars per year before benefits and payroll taxes.

Utilities and Insurance

Utility bills remain manageable, often 20 to 30 percent lower than national averages.

Energy costs stay consistent due to regulated pricing.

Basic commercial insurance plans for small retail or warehouse operations range between 120 and $200 per month.

Overall Monthly Estimate

An average e-commerce startup with a 10,000 square foot space and two employees can expect a minimum fixed cost of 14,000 dollars per month before shipping, packaging, and marketing.

Last Words

A lot of new e-commerce founders are heading to South Dakota. We now understand why.

Low taxes. Strong infrastructure. Straightforward policies. Everything is set up to support long-term growth.

Fast shipping, easy digital access, and strong local support also play an important role.

For anyone ready to start an online business, South Dakota offers a steady, profitable path forward.