Medicare has four parts, and each one has a clear job. Part A covers hospital care. The Medicare Part B covers doctor visits and outpatient care. Part C, called Medicare Advantage, bundles Parts A and B through a private plan and often adds extra benefits. Part D covers prescription drugs.

Confusion starts because the parts can overlap, and gaps show up when coverage is put together the wrong way.

Many people hit 65 thinking Medicare covers everything. That idea usually falls apart after the first hospital stay, a round of specialist visits, or a pricey medication at the pharmacy.

Medicare is a setup with multiple pieces, not one all-in-one policy. Costs depend on how those pieces are combined.

Medicare Part A: Hospital Insurance and Inpatient Care

| Primary Purpose | Covers inpatient hospital care, hospice, and limited skilled nursing |

| Who Runs It | U.S. Federal Government (CMS) |

| Monthly Premium | $0 for about 99 percent of beneficiaries who paid Medicare taxes |

| Deductible (Per Benefit Period) | $1,632 per hospital stay |

| Daily Copays (Long Stays) | Days 61–90: about $408 per day, after 90 days up to $816 per day using lifetime reserve |

| Lifetime Reserve Days | 60 total days for the entire lifetime |

| Average Hospital Stay for Seniors | About 5.5 days per admission in the U.S. |

| What It Does NOT Cover | Doctor fees, outpatient care, and long-term nursing homes |

| Financial Risk | Unlimited exposure to repeated hospitalizations |

| Enrollment Timing | Automatic at 65 for most people already on Social Security |

Part A is the foundation of Medicare. It exists for one primary purpose: to pay for inpatient medical care that happens when you are formally admitted into a hospital or medical facility. If your name is on a hospital admission form, Part A is doing the billing work behind the scenes.

Part A covers hospital stays, skilled nursing facilities after a qualifying hospital stay, hospice care for terminal illness, and limited home health services following hospitalization. This means if you are admitted for surgery, an accident, a stroke, or a serious infection, Part A is what activates your hospital coverage.

Most Americans pay no monthly premium for Part A because they have already paid into the system through payroll taxes while working. This creates a false sense of security. While the premium may be zero, the cost-sharing is not.

Each hospital stay triggers a deductible that resets by benefit period, not by calendar year. Long hospital stays are then converted into daily copayments that grow rapidly.

What Part A does not cover is just as important as what it does. It does not pay for long-term nursing home care if you only need custodial help. The same is for private rooms unless medically required.

It does not cover personal assistance like dressing, bathing, or feeding unless tied to skilled medical care.

Part A protects you from catastrophic hospital bills, but it does not eliminate them.

Medicare Part B: Medical Insurance for Daily Healthcare

| Primary Purpose | Covers doctor visits, outpatient care, imaging, lab tests, and preventive care |

| Who Runs It | U.S. Federal Government (CMS) |

| Standard Monthly Premium | About $175 per month for most enrollees |

| Income-Based Surcharges (IRMAA) | High earners pay up to $590+ per month |

| Annual Deductible | About $240 per year |

| Coinsurance After Deductible | 20 percent with no spending cap |

| Average Annual Out-of-Pocket (Averages) | $2,000–$6,000 for moderate chronic care |

| Services Covered | MRIs, CT scans, chemo, dialysis, mental health outpatient |

| Services Not Covered | Dental, vision, hearing, and retail prescriptions |

| Financial Risk | No maximum annual limit on medical spending |

If Part A handles hospital walls, Part B handles everything that happens after you walk outside those walls. This includes doctor visits, outpatient surgery, diagnostic testing, preventive screenings, durable medical equipment, and outpatient mental health services.

Part B is what pays when you see your primary care doctor, visit a cardiologist, get an MRI, receive chemotherapy as an outpatient, or use oxygen equipment at home. It also covers preventive services like cancer screenings, diabetes testing, and annual wellness visits.

Unlike Part A, Part B always has a monthly premium. That premium increases for high-income earners through income-related adjustments.

Beyond that, Part B also includes an annual deductible and a standard 20 percent coinsurance with no maximum spending limit. This means if you have repeated medical needs, there is no built-in financial ceiling.

What Part B does not cover includes most prescription medications, routine dental care, vision exams, hearing aids, cosmetic procedures, and long-term custodial care.

These exclusions are often where retirees feel the biggest shock because these are some of the most common everyday expenses.

One of the clearest real-world examples of how Medicare structure affects long-term health outcomes is what happens when people delay orthopedic care, especially shoulder injuries. A damaged rotator cuff rarely heals on its own once the tear becomes significant.

Many retirees try to manage the pain with injections, physical therapy, or rest because they worry about cost exposure under Part B. But the medical reality is harsh.

The longer the surgery is delayed, the more muscle tissue weakens, the tendon retracts further, and the chance of full functional recovery drops. These are the real consequences of delaying rotator cuff surgery, and they go far beyond temporary pain.

Patients often lose overhead strength permanently, develop chronic inflammation, and face longer, more complex rehabilitation afterward.

Medicare Part C: Medicare Advantage as a Private Replacement

| Primary Purpose | Replaces Parts A and B with a private insurance plan |

| Who Runs It | Private insurers regulated by Medicare |

| Enrollment Penetration | Over 51 percent of all Medicare users now use Part C |

| Average Monthly Premium | $18–$25 per month nationally |

| Drug Coverage | Included in 90+ percent of plans |

| Dental & Vision Coverage | Included in most urban plans |

| Provider Access | Network-based (HMO or PPO structure) |

| Prior Authorizations | Required for many surgeries and imaging |

| Annual Out-of-Pocket Maximum | Usually $3,500–$8,850 depending on plan |

| Geographic Limitations | Coverage tied to the county or service region |

| Financial Model | Predictable copays but restricted access |

Part C is widely misunderstood. It does not add to Medicare. It replaces Parts A and B entirely with a single private insurance policy.

You still must be enrolled in Parts A and B, but your care is administered and billed by a private insurance company approved by Medicare.

Every Medicare Advantage plan is legally required to cover everything that Original Medicare (Parts A and B) covers. But nearly all Advantage plans also add features that traditional Medicare does not include, such as prescription drug coverage, dental benefits, vision exams, hearing aids, fitness programs, and telehealth services.

This extra coverage is why many people are drawn to Part C. Monthly premiums are often lower than Original Medicare paired with Medigap. Many plans advertise zero-dollar premiums. What is rarely emphasized is the trade-off.

Medicare Advantage plans operate with provider networks, referral systems, and prior authorizations. You typically cannot go to any doctor nationwide. You must stay within regional networks, and many services require approval before treatment begins.

This makes care more controlled and more affordable on paper, but also more restricted in practice.

One major financial advantage is that Part C plans include a yearly out-of-pocket maximum. Once you hit that cap, the plan pays the rest of the year. Original Medicare does not have such a limit.

Part C is functionally a fully managed insurance product built on top of Medicare’s legal structure.

Medicare Part D: Prescription Drug Coverage

Part D exists for only one reason: to pay for retail and mail-order prescription drugs.

It is offered exclusively by private insurers and operates separately from Parts A and B unless bundled into a Medicare Advantage plan.

Each Part D plan uses a formulary, which is a list of covered drugs divided into pricing tiers. Generic medications usually cost very little, while brand-name and specialty drugs can be very expensive even with coverage.

Part D includes monthly premiums, deductibles, copayments, and coinsurance. Many users also interact with the “coverage gap” phase, where cost-sharing increases after a certain spending threshold before catastrophic coverage kicks in.

Part D does not pay for drugs given in hospitals, infusion centers, or doctors’ offices. Those are covered by Parts A or B. It also does not cover most over-the-counter medications, cosmetic drugs, or weight-loss prescriptions.

For anyone taking even one long-term prescription, Part D is not optional in practical terms. Without it, medication costs become uncontrollable very quickly.

The Problem With How Medicare Is Put Together

The biggest misconception about Medicare is that it functions like employer insurance. It does not.

Original Medicare leaves unlimited financial exposure unless you add private protection.

A person with only Parts A and B will face:

- Uncapped 20 percent medical bills

- No prescription drug protection

- No dental, vision, or hearing coverage

- Unlimited financial liability during serious illness

- A person on Medicare Advantage will face:

- Provider network restriction

- Prior authorization delay

- Regional coverage limitations

- Lower monthly premiums

- An annual out-of-pocket ceiling

Example: Same Health Problem, Two Different Medicare Choices

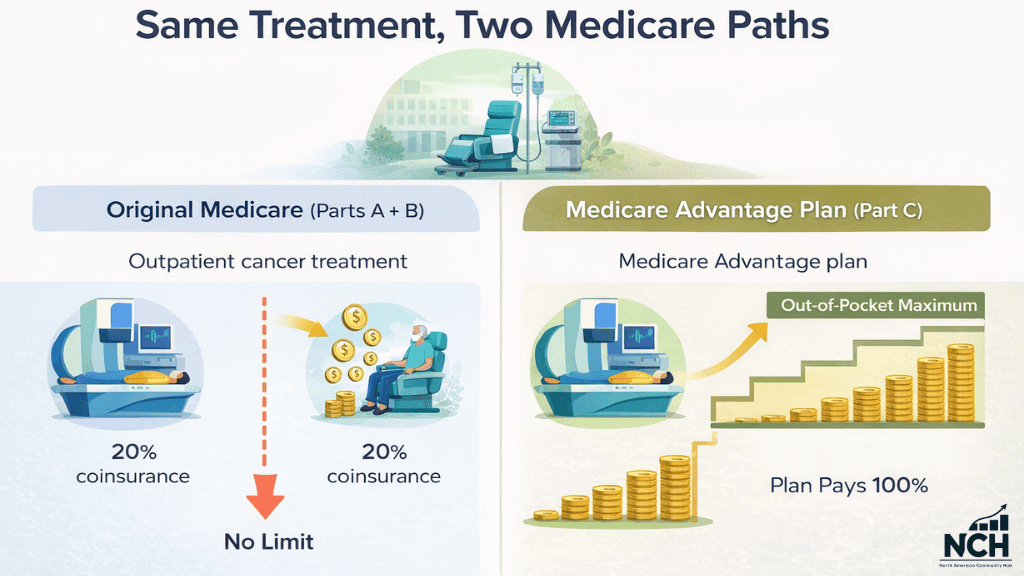

Two retirees both need outpatient cancer care. That can mean chemo every week, regular lab work, scans, specialist visits, and follow-ups. None of it happens once. It happens over and over, and each visit comes with a bill.

Person one has Original Medicare with Parts A and B only.

Medicare pays most of each approved charge. The patient keeps paying the remaining share, often 20% for outpatient care under Part B. That sounds manageable on a single visit. Over months of treatment, it can turn into thousands of dollars. Original Medicare by itself does not set a yearly cap on what the patient pays for Part B services, so the total can keep rising as long as care continues.

Person two has a Medicare Advantage plan.

The plan sets fixed copays for many services, like a certain amount for a specialist visit, chemo, or imaging. Costs still add up, especially early in the year.

The difference comes later. Medicare Advantage plans include a yearly out-of-pocket maximum for covered services. Once the patient reaches that limit, the plan covers the rest of the covered costs for the rest of the year.

Both retirees can receive the same treatment plan. The gap shows up in the bill. Original Medicare alone can keep charging a share with no yearly limit.

Medicare Advantage puts a ceiling on what the patient pays in a year, which can change the risk for anyone facing long, expensive treatment.

Last Words

Medicare is not healthcare security by default. It is a framework that requires planning. The quality of your retirement healthcare does not depend on whether you have Medicare. It depends on how intelligently your Medicare parts are structured together.

Most financial disasters in retirement do not come from a lack of coverage. They come from misunderstanding coverage.