Many people notice a consistent contrast in retirement confidence between Canada and the United States.

Canadians often feel more secure because their government programs, healthcare system, and financial protections create a stronger foundation for long-term stability.

A reinforced public structure reduces personal financial strain and helps retirees plan with fewer unknowns.

Retirement Income Expectations: Comparing the “Magic Numbers”

Retirement planning in Canada and the United States often begins with a target figure that reflects how much someone believes they must accumulate to maintain a comfortable lifestyle:

- Canadians currently estimate they need about CA$1.7 million

- Americans expect to need about US$1.26 million

Perceptions around these targets reveal how each country’s system shapes financial confidence.

Canadians tend to set a higher target number, yet many feel more assured about achieving it due to reduced personal risk and stronger public programs.

A gap forms because healthcare and long-term care costs stay far lower in Canada, and public benefits play a larger role in supporting basic expenses.

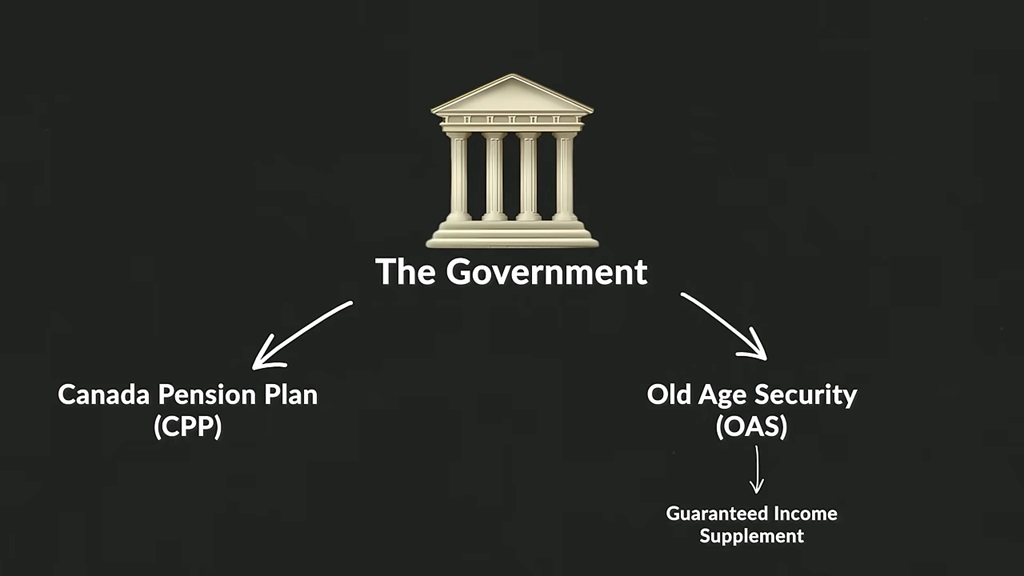

Programs such as the Canada Pension Plan, Old Age Security, and the Guaranteed Income Supplement offer monthly income that reduces pressure on personal savings.

Some financial planners point out several figures that help show how expectations differ across the border:

- Canadians face long-term care costs of around CA$2,500 to CA$3,000 each month, creating less strain on retirement funds.

- Americans often face long-term care costs of US$8,000 to US$9,000 each month, placing a heavier weight on private savings.

- Canadians often rely on predictable public benefits that cover more essential needs than similar programs in the United States.

Many planners advise aiming to replace around 70 to 80% of pre-retirement income each year.

Canadians often reach this target more reliably because personal savings do not need to absorb unpredictable medical bills and because public benefits add a steady supplemental income.

Government Pensions: Stability and Sustainability

Canada and the United States take different approaches to public pensions, shaping how citizens perceive their financial future.

Canada’s structure uses multiple programs working in tandem, while the United States depends primarily on Social Security.

Canada’s System

Canada Pension Plan forms the core of the country’s mandatory pension structure.

It uses payroll contributions tied to workers’ earnings and invests those funds through an independent organization designed to limit political influence.

Sustainability reviews show CPP can support retirees for more than seventy-five years, giving contributors a measure of confidence that their benefits will remain intact.

Maximum CPP benefits in 2024 reach about CA$1,306 per month at age seventy.

Old Age Security adds another stable income source.

Funded through general tax revenue rather than paycheck deductions, OAS provides monthly payments that adjust with inflation. Maximum payments in 2024 range roughly between CA$740.09 and CA$814.10

A clawback begins around CA$86,000 of annual income, ensuring benefits target those with modest or moderate retirement resources.

Lower-income retirees may receive the Guaranteed Income Supplement, offering additional monthly support.

GIS plays a crucial role for seniors who do not possess extensive savings, helping prevent significant declines in living standards.

A three-part system emerges as a result: one plan based on contributions, one based on residency, and one based on financial need.

U.S. Social Security

Social Security serves as the primary public pension for Americans, but long-term funding challenges create uncertainty that affects future retirees.

Projections show that trust funds may deplete by 2034. Even after depletion, about 75% of scheduled benefits would still be paid through ongoing payroll taxes, but a reduction of that size would affect millions of households.

Maximum monthly benefits in 2024 reach about US$4,873 at age seventy.

Policy adjustments continue to shape the program.

The Social Security Fairness Act of 2025 removed reductions created by WEP and GPO, improving outcomes for workers who previously saw their benefits lowered due to employment with certain public sector positions.

Healthcare in Retirement

Healthcare outcomes shape retirement plans more than almost any other factor.

Retirees in Canada and the United States face very different systems, and those differences influence how individuals prepare financially for aging and long-term medical needs.

Canada offers a model built on universal access, while American retirees navigate several layers of coverage.

Canada

Universal healthcare removes co-pays and deductibles for essential physician and hospital services, making unexpected medical bills far less common.

Provincial systems generally charge little or no annual premium.

Retirees also encounter long-term care costs that average around CA$2,500 to CA$3,000 per month, far lower than what Americans typically pay.

Several points show the effectiveness of this system for retirees:

- Essential services require no point-of-care billing.

- Annual healthcare fees often remain within the range grom CA$75 – CA$200.

- Long-term care facilities operate at a fraction of U.S. cost levels.

Lower exposure to large medical expenses allows Canadians to preserve personal savings and focus their planning on discretionary goals rather than emergency funding.

In addition to long-term care, senior independent living options have become increasingly popular among older Canadians who are still active but want a more supportive, maintenance-free lifestyle.

These communities cater to self-sufficient seniors who desire private suites, optional meal plans, housekeeping, and built-in social opportunities, without the need for medical or personal care services.

United States

Medicare provides broad support only when layered with additional components.

Part A remains free for most retirees, though Part B averages around US$175 per month.

Retirees often purchase Medigap or Medicare Advantage plans, which frequently exceed US$200 each month.

Long-term care typically averages between US$8,000 and US$9,000 per month, creating strain for individuals who lack substantial private savings or long-term care insurance.

Several financial risks often arise for American retirees:

- Lifetime medical costs may surpass US$413,000.

- Medicare excludes essential services such as long-term care, dental, and vision without supplemental coverage.

- High variability across providers and states makes planning more difficult.

Why Canada Feels Safer

Universal coverage minimizes catastrophic risk.

Predictable costs allow retirees to plan with greater confidence and reduce the need for large savings earmarked solely for medical emergencies.

Lower financial exposure shapes a more secure retirement experience.

Taxation in Retirement

Income taxation influences retirement affordability, shaping how far pension and investment income can stretch.

Retirees in Canada and the United States face different tax structures that affect long-term financial planning.

Canada

Middle-income retirees generally experience combined tax rates of about 20% to 30%.

Capital gains taxation applies to half of any realized gain, allowing investments to remain relatively tax-efficient.

Canada imposes no estate tax, simplifying inheritance planning. Foreign pension income may still be taxable, but credits help reduce duplication for individuals who split time or income sources across the border.

Several traits define Canadian taxation in retirement:

- Predictable brackets and fewer regional differences simplify planning.

- No estate tax eliminates concerns about federal transfer penalties.

- Income-tested benefits encourage steady, moderate withdrawals.

United States

Federal income tax rates for retirees typically fall between 10% and 22%.

State taxes vary widely, producing major differences in total tax burden based on residency.

Some states exempt retirement income entirely, while others tax Social Security. Estate tax applies only above about US$13.6 million.

Factors that influence American retirement taxation include:

- Significant variation across states.

- Complex rules for taxation of Social Security benefits.

- Higher potential tax exposure on investment income in some regions.

Retirement Accounts

Personal savings programs add another layer to retirement planning.

Contribution limits, withdrawal rules, and tax treatment differ significantly between Canada and the United States, shaping how retirees and workers build long-term security.

Canada

Registered Retirement Savings Plans allow contributions equal to 18% of income up to CA$32,490 in 2025. RRSPs must convert to a Registered Retirement Income Fund by age seventy-one, creating a structured withdrawal phase.

Tax Free Savings Accounts permit CA$7,000 per year, with a cumulative room now near CA$95,000. TFSA withdrawals remain tax-free, and room is restored in the following year.

Several structural components strengthen these programs:

- TFSA withdrawals never influence income-tested benefits such as GIS.

- RRSP contributions reduce taxable income during peak earning years.

- Unused contribution room accumulates indefinitely.

United States

401(k) plans allow contributions up to US$23,500 in 2025, with an additional US$7,500 permitted for those aged fifty or older.

IRAs cap contributions at US$7,000 plus a US$1,000 catch-up. Early withdrawals typically face standard income tax plus a 10% penalty.

Roth IRAs offer tax-free growth but enforce strict rules on income eligibility and withdrawal timing.

Several issues often shape American retirement planning:

- Required minimum distributions may increase taxable income late in retirement.

- Roth IRA eligibility phases out at higher incomes.

- Penalties limit early access to funds, increasing rigidity.

Cost of Living and Retirement Affordability

Retirement outcomes depend heavily on local living costs. Housing, taxes, healthcare premiums, and currency movement all influence how far savings can stretch in Canada and the United States.

Housing remains one of the largest expenses. Toronto rents average about CA$2,300 per month, while cities such as Phoenix average around US$1,500.

Property taxes in Canada often fall under 1%, including cities like Calgary, while many U.S. states exceed 2%.

Healthcare adds a significant divide. Canadian retirees usually pay minimal provincial premiums, while American retirees often spend US$500 or more each month on Medicare and supplemental plans.

Currency exchange introduces another financial strain. Retirees who draw income across borders may lose around 2% to 3% on every transfer, slowly eroding purchasing power over time.

Why Retirement Feels Safer Up North

Canada delivers stable multi-layered pensions, dependable healthcare, and streamlined retirement accounts that reduce stress and long-term risk.

Predictable taxation and lower medical costs help retirees plan without excessive uncertainty.

Many Canadians accept slightly higher taxes in return for a system that offers lasting security and more confidence throughout retirement.