In late November, the US renewed one-year exemptions for 178 imports from China that many American factories still rely on. The broader tariff rules stayed in place, a clear sign that tariffs will keep shaping US manufacturing in 2026.

Tariffs matter because they raise the price of many imported goods and parts. Earlier coverage showed how higher costs and disrupted supply lines hit small businesses first, sometimes even forcing closures. Yet the story does not end there. A growing number of companies are shifting production back to the US or expanding existing plants. Their goal is to cut dependence on suppliers in countries facing heavy tariffs.

As imports get more expensive, producing in the US can start to look like the steadier and more affordable option, and that is already pushing some companies to invest at home.

The following sections will show which industries are set to expand in 2026, how tariffs are pushing that shift, and what could still slow it down.

Sectors Most Likely to Grow in 2026

Tariffs are forcing companies to rethink where they make things, because importing many parts and products now costs more and feels less predictable.

In the past month, factory announcements and demand numbers have made four industries look like the clearest leaders for 2026.

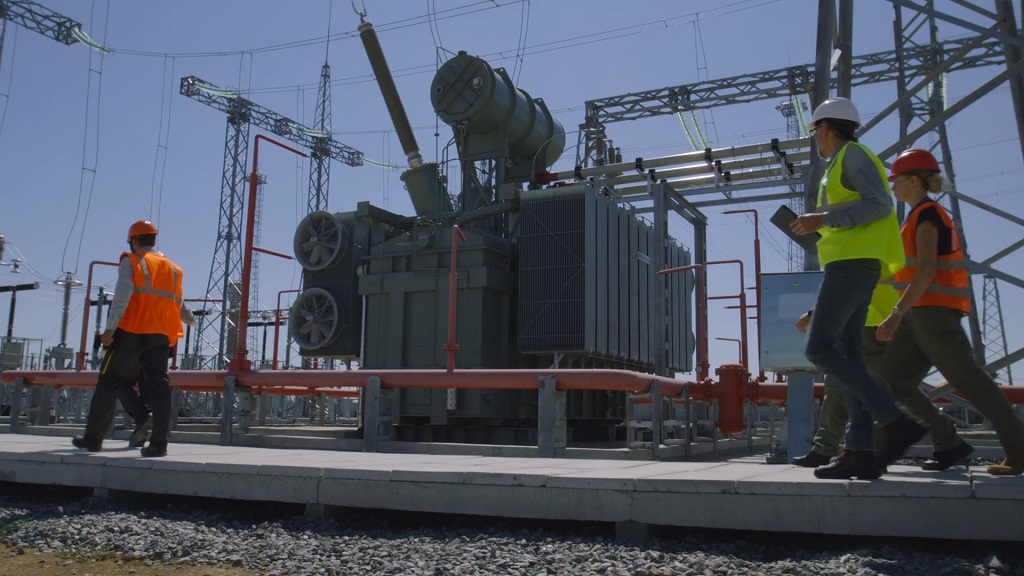

1. Grid And Power Equipment

Grid hardware looks like the strongest near-term winner because demand is already overwhelming supply.

Industry data shows U.S. demand for big generation step-up transformers up about 274% from 2019 to 2025, and average delivery times hitting roughly 143 weeks in mid-2025.

That is close to three years of waiting for a core piece of equipment.

Manufacturers are reacting with major US builds timed for 2026.

Hitachi Energy has committed more than $1 billion to new and expanded US capacity, including a $457 million transformer plant, while Siemens and several rivals are also adding factories.

Tariffs reinforce the case by raising the cost of imported transformers and high-voltage parts, so domestic supply becomes the faster and more predictable option for utilities and data center builders.

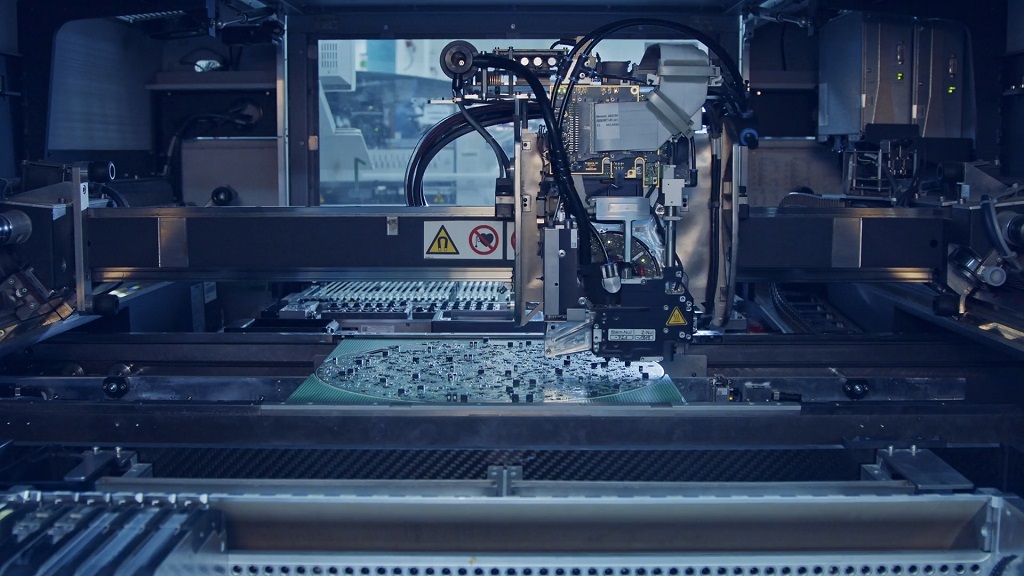

2. Semiconductors And Chipmaking Tools

The US CHIPS research program just put up to $150 million into xLight, a startup developing a high-power EUV laser source, a critical building block for advanced lithography.

Tariffs add pressure on sensitive imported chip inputs and support the national-security drive for domestic supply.

Expect 2026 gains to show up most clearly in tools, specialty components, materials, and advanced packaging, with finished chip output scaling more gradually.

3. Pharmaceuticals And Biomanufacturing

Drug makers are putting large money behind domestic production again.

The best example is Novartis.

They are building a $771 million manufacturing hub in North Carolina, planned as roughly 700,000 square feet of new and upgraded space, with about 700 jobs tied to biologics, sterile packaging, and solid-dose production.

High-value medicines are where domestic production pays off first, so more projects like this one are likely to follow.

4. Industrial Equipment Serving AI, Data Centers, And Electrification

The AI boom is also a factory boom. US data center power demand is forecast to reach about 75.8 GW in 2026, a sharp jump driven by hyperscale AI builds.

Every new campus needs massive physical output: cooling systems, power modules, switchboards, automation gear, and heavy electrical parts.

Schneider Electric said it has about $2.3 billion in US data center power and cooling deals, mainly tied to multi-year buildouts.

Tariffs make imported, heavy industrial parts more expensive and harder to get on schedule, so companies start looking for US-made alternatives.

Data center and electrification projects run on tight timelines, and builders often pick domestic suppliers to avoid long overseas waits, even if the price is a bit higher.

Small businesses can handle tariffs by buying more from US suppliers, joining with other local firms to place bigger orders, and choosing vendors with reliable delivery. Logmanager, a Graylog alternative, can help spot outages or slowdowns during the switch. A structured review of system performance can also keep transitions on track and reduce unexpected downtime.

What The Latest Tariff Moves Mean For US Factories

The latest actions brought a few concrete policy moves that factories now have to price, source, and plan around.

Here are the specific changes.

One-Year Extensions For 178 China Import Exemptions

Renewed exemptions cover items US plants still rely on, including some solar-manufacturing equipment, electric motors, pump parts, printed circuit boards, auto HVAC compressors, and certain medical-device components.

Exemptions now run through late 2026 unless renewed again.

Fentanyl-Linked Duty Cut From 20% To 10% On A Narrow Set Of China Goods

The rate drop applies to a limited slice of products tied to the fentanyl dispute.

Scope stays small, yet the move shows targeted easing while the main tariff system remains in force.

Reciprocal And Country-Specific Tariffs From 2025 Stayed Active

New reciprocal tariffs continue on top of older Section 301 and 232 duties.

The result is a layered tariff map where rates vary by product category and by trading partner.

Here is a chart showing how tariff rates differ by country and by product right now.

| Trading Partner | Product Category | Current Tariff Treatment | What Makes It Different |

| China | Many industrial and medical goods | Section 301 tariffs still apply, but 178 specific items are exempt through late 2026 | Same country, different products: the exempt list includes certain solar-making equipment, electric motors, PCBs, pump parts, auto HVAC compressors, and some medical components, while most other China imports keep full tariffs. |

| China | Fentanyl-related dispute category | Duty cut from 20% to 10% on that narrow slice | One partner can face different rates depending on the product group and dispute channel. |

| South Korea | Autos | 15% tariff, retroactive to Nov 1 | A negotiated, country-specific rate for one sector that does not apply to other sectors. |

| South Korea | Semiconductors and pharmaceuticals | National-security tariffs capped at 15% | Sector caps can override the general tariff stack for a given partner. |

| Canada | Goods that do not qualify under USMCA | Reciprocal tariffs up to 35% | The neighboring partner gets a much higher reciprocal rate unless the product meets USMCA rules. |

| India | Broad import basket | Reciprocal tariff rate 25% | Different partner, different country rate under the reciprocal schedule. |

| Taiwan | Broad import basket | Reciprocal tariff rate around 20% | The same type of product can face a different rate purely due to origin. |

| South Africa | Broad import basket | Reciprocal tariff rate around 30% | Another partner, another country-specific reciprocal rate. |

| Most other partners | Broad import basket | 10% baseline reciprocal tariff | Default rate applies unless a country-specific rate, sector tariff, or exemption overrides it. |

Source: Van Andel Global Trade Center

Where New Plants And Expansions Are Underway Right Now?

Projects are concentrating in places where demand is surging, supply chains already exist, and states are offering clear support.

A few corridors are forming in plain sight.

Grid And Power Equipment Belt In The Southeast And Mid Atlantic

Large electrical equipment plants are the busiest construction story in manufacturing.

Transformer makers and high-voltage component suppliers are expanding in Virginia, the Carolinas, Tennessee, and nearby states.

The driver is simple: utilities and data center builders need far more transformers and switchgear than the market can deliver on time, so companies are building capacity close to the end buyers.

Expect more concrete, steel, and hiring tied to grid hardware in that region through 2026.

AI Server And Data Center Equipment In The Midwest

A second cluster is forming around hardware for AI and data centers.

Wisconsin has become a visible example, with major electronics assembly moving toward AI server production.

The Midwest pitch is strong for firms that need large sites, stable power, and a workforce with manufacturing experience.

Similar moves are showing up in neighboring states that can support high-volume electronics and industrial equipment lines.

Pharma And Biomanufacturing In North Carolina

North Carolina remains one of the main magnets for new drug and biologics plants.

Large pharmaceutical firms are building or expanding campuses in the Raleigh-Durham corridor, drawn by existing life-science talent, research ties, and a track record of supporting regulated manufacturing.

Clean Energy And Industrial Components In The Sun Belt

Battery materials, solar equipment, and related industrial parts are concentrated in the Sun Belt, especially Texas, Georgia, Arizona, and Nevada.

Companies pick those states for available land, logistics, and aggressive incentive packages.

Many of these sites are designed to feed both domestic demand and nearby North American partners.

How Manufacturers Are Rebuilding Supply Chains Under Tariffs

Manufacturers must rebuild supply lines to cut tariff exposure and avoid sudden stoppages.

The most common moves look like this:

- Move high-tariff parts to domestic suppliers: When duties raise import costs, local producers become competitive, especially for heavy or time-sensitive components.

- Run a two-track sourcing model: Critical inputs come from the US or North America, while lower-risk items still come from overseas. That way, a tariff shock hits only part of the bill of materials.

- Hold more inventory for vulnerable items: Extra stock costs money, yet it can be cheaper than shutting down a line because one tariff-hit part is stuck at a port.

- Redesign products to use fewer tariff-exposed inputs: Engineers swap materials, standardize parts, or simplify assemblies so the tariff burden shrinks.

- Shift some sourcing to “tariff-lighter” countries: Rather than a full reshoring move, many firms reroute orders to partners with lower duties.

Reshoring, when it happens, usually comes in pieces.

A factory might bring final assembly home first, then localize one or two key sub-assemblies, while other parts stay imported until a domestic option exists.

Large manufacturers handle that transition faster because they can qualify new vendors, pay for dual sourcing, and carry inventory buffers.

Smaller manufacturers often feel more strain, since they buy in smaller volumes and have less room to absorb sudden cost swings.

The Cost Problem: Inputs, Prices, And Who Gets Hit

Tariffs mostly show up as higher bills. For a factory, that means paying more for parts, materials, shipping, and the extra stock needed to avoid sudden shortages.

Where The Costs Come From

First, tariffs raise the price of imported inputs. Many US plants still buy steel, aluminum, electronics, motors, and specialty parts from abroad, so a duty adds cost right away.

Second, prices rise even for domestic parts. When imports get pricier, more buyers rush to US suppliers, and local prices climb too.

Third, delays create their own costs. To keep lines running, companies hold more inventory, which ties up cash and adds storage and financing costs.

Who Gets Hit Hardest

Smaller manufacturers feel it most. They buy less, have fewer supplier options, and cannot absorb sudden jumps as easily.

Factories that rely on lots of imported sub-parts take another hit. One pricey component can raise the cost of the whole product.

Exports And Retaliation: The Other Side Of The Tariff Story

MAGNET Tariffs and Turbulence report, drawing on the 2025 Ohio Manufacturing Survey of about 270 manufacturing leaders, shows how the impact has been split.

One third of respondents said tariffs changed sales either way.

Within that group, about 18% reported sales losses and 15% reported sales gains.

Losses ran near minus 16%, while average gains were around plus 9%.

In plain terms, more firms lost export sales than gained domestic sales, and the losses tended to be larger.

Retaliation is a big driver. Other countries often respond to US tariffs by putting taxes on US products that are simple to target and make a public statement.

They pick goods that lots of voters notice, like farm products or famous brand items, because that creates political pressure inside the US.

For manufacturers, the effect shows up quickly as smaller foreign orders, tougher price demands from overseas customers, and contracts shifting to competitors in countries outside the tariff fight.

The report includes exporters describing sharp declines in orders from Mexico after retaliatory duties landed.

Export exposure is highest in industries where customers can switch suppliers fast:

- Industrial machinery and equipment

- Auto parts and transport components

- Specialty metals and fabricated goods

- Chemicals and advanced materials

Regional Federal Reserve reporting has flagged margin pressure tied to tariffs in several districts, which fits the double squeeze on export-heavy manufacturers.

Three Paths For Manufacturing In 2026

Manufacturing next year can break in a few clear directions.

Tariffs are only one part of the mix, yet they interact with demand, financing, and export conditions in ways that shape where growth shows up and where it does not.

1. Targeted Boom In Strategic Sectors

Growth stays focused on lanes where demand is already intense, and policy keeps backing expansion.

Grid equipment sits at the front because transformer shortages remain severe, so capacity that comes online in 2026 steps into a long waiting line.

Chips follow through the supporting chain first, with tool makers, materials suppliers, and advanced packaging scaling sooner than full fab output.

Pharma keeps building domestic lines through big hubs like the previously mentioned Novartis project in North Carolina.

AI and data-center construction keep pulling orders for power hardware, cooling systems, and automation gear.

Result

- Strong expansion in a few industries

- Visible factory openings and hiring in those lanes

- Spillover gains for suppliers tied to those chains

2. Slow, Uneven Recovery With A Cost Squeeze

Manufacturing improves overall, yet gains arrive in patches.

Tariff-heavy inputs keep many production lines expensive to run, so a lot of companies expand carefully and only where returns look sure.

Export demand stays shaky because global trade is cooling, and retaliation risk hangs over some categories.

Result

- Modest national growth, stronger in select regions

- Big manufacturers moving ahead, smaller plants under pressure

- More investment in efficiency and automation rather than pure capacity

3. Tariff Shock And Broader Stall

Another downside path appears if tariff rates jump again or retaliation spreads further.

Input bills rise fast on parts without quick domestic substitutes, export orders drop in exposed sectors, and managers react by freezing hiring or delaying projects.

Result

- Wider slowdown outside protected niches

- Fewer new projects approved after current builds

- Sharper stress for exporters and smaller manufacturers

Taken together, 2026 most likely lands between Path One and Path Two unless a new tariff jolt pushes conditions toward Path Three.

What To Watch In The First Half Of 2026

Key indicators that will show which way manufacturing is heading.

| Signal To Watch | Where It Comes From | What It Tells You |

| ISM Manufacturing PMI And New Orders | Monthly ISM report | PMI above 50 for a few months, plus rising new orders, means factories are growing beyond a few hotspots. PMI stuck below 50 means growth stays limited. |

| Core Capital Goods Orders | Monthly Durable Goods report | Rising orders show companies are buying new machines and committing to more production. Flat or falling orders show hesitation. |

| Manufacturing Construction Spending | Monthly Census construction data | More spending means more factory projects moving ahead. A flat trend means the buildout pipeline is slowing. |

| Transformer Backlogs And Lead Times | Quarterly updates from grid-equipment makers | Big backlogs and long lead times mean grid manufacturing stays in high demand. Lead times dropping fast would signal supply catching up. |

| New CHIPS Act Funding Deals For Tools, Materials, And Packaging | Rolling Commerce Department announcements | More deals for chip tools, chipmaking materials, and chip packaging mean the chip supply chain in the US is still expanding into 2026. Fewer or delayed deals mean a softer lift. |

| Export Volumes In Machinery, Auto Parts, Metals, And Chemicals | Monthly US trade data | Stable or rising exports mean retaliation is not biting much. Falling exports point to tariff payback hurting sales abroad. |

| Manufacturing Hours And Jobs | Monthly US jobs report | Hours rising first, then jobs, show factories getting busier. Hiring only in a few sectors confirms a targeted boom, not a broad one. |

| Tariff Rule Changes And Exemption Updates | USTR and Customs notices | Stable rules or new exemptions help firms plan and invest. New tariff hikes or sudden rule shifts raise costs and can pause expansion plans. |

The Bottom Line

Tariffs are giving parts of US manufacturing a push into 2026, but only in places where demand is already strong and companies can build supply fast.

Grid hardware, chip supply chains, pharma capacity, and AI-driven industrial gear look set to add plants and jobs.

Smaller manufacturers that bring in a lot of parts from abroad will keep paying more for inputs, which squeezes margins and slows investment.

Expect a year of uneven gains, with clear winners in strategic sectors and a long tail of firms forced to adapt just to stay competitive.