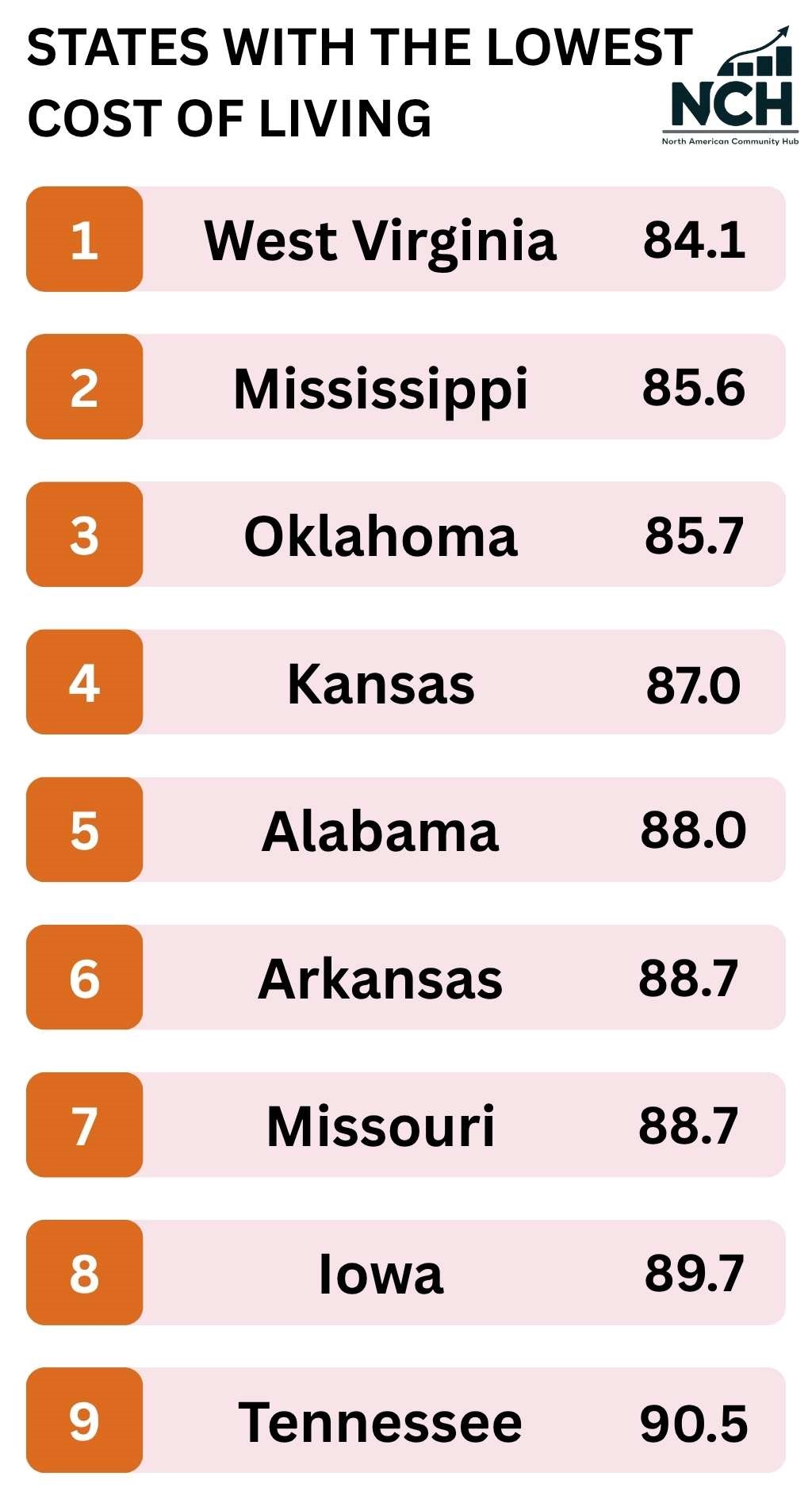

In 2025, the most affordable states in the U.S. sit mainly in the South and Midwest, where daily costs stay well below the national average of 100 on the cost of living index.

Below is a clear look at the states with the lowest living expenses.

Key Takeaways

- West Virginia ranks as the most affordable state in the U.S. for 2025, with an overall cost of living index of 84.1, nearly 16% below the national average. Housing is the main factor, averaging 40% cheaper than the U.S. norm. Close behind are Mississippi (83.3–87.9) and Oklahoma (85.7), both offering low housing costs, cheap utilities, and favorable taxes for working families and retirees.

- Housing and taxes drive affordability across the South and Midwest. Homes in states like Arkansas, Alabama, and Kansas cost 25–35% less than the national median, while property taxes in Alabama and Arkansas stay below 0.6%. Even with moderate incomes, residents can own homes and maintain a comfortable lifestyle.

- Retirees benefit the most in these low-cost states. Tennessee, Missouri, and Iowa combine affordable healthcare, moderate living expenses, and strong tax advantages, including no tax on Social Security in many cases. Fixed incomes stretch further, often by 10–20%, making retirement budgets easier to manage without sacrificing comfort.

1. West Virginia

| Category | West Virginia | U.S. Average |

|---|---|---|

| Overall Cost of Living | 84.1 (15.9% below average) | 100 |

| Housing Index | 59.9 (~40% cheaper) | 100 |

| Median Home Value | $163,700 | $340,200 |

| Median Rent (2BR) | ~$1,100/month | ~$2,000/month |

| Grocery Index | 99 (about average) | 100 |

| Utilities Index | 96.6 (~3.4% below) | 100 |

| Healthcare Index | 97.7 (~2.3% below) | 100 |

| Transportation Index | 93.1 (~7% below) | 100 |

| State Income Tax | Top rate ~5% | Varies by state |

| Sales Tax | 6% (minimal local taxes) | Avg ~7.3% |

| Property Tax Rate | ~0.58% (very low) | Avg ~1.10% |

| Individual Annual Cost | ~$34,000 | ~$40,000 |

| Family Living Wage (4 ppl) | ~$62,635 | ~$68,800 |

| Median Household Income | ~$55,948 | ~$74,580 |

| Retiree Benefits | No tax on Social Security; low property tax | Varies, often taxed |

West Virginia has the lowest overall cost of living in the country, at about 15–16% below the U.S. average, according to ramseysolutions.com

Extremely inexpensive housing is the primary driver of West Virginia’s low living costs. Key statistics and comparisons for West Virginia are given below:

With an index of 59.9, housing costs are around 40% cheaper than the national average. The median home value is $163,700, and the median rent for a 2-bedroom apartment is about $1,100, well below the U.S. average of ~$2,000.

Grocery prices are near the national average (index ~99), while utilities are slightly cheaper (index 96.6, ~3.4% below average).

Costs are also near average (index 97.7), offering only slight savings.

With an index of 93.1, transportation expenses are about 7% lower, thanks to cheaper gas and shorter commutes. Annual savings are roughly $700 compared to national averages, according to Mericmo.gov.

West Virginia has a moderate tax structure. The top income tax rate is ~5%, with plans to lower it further. Sales tax is 6%, and property tax is very low (0.58%), which especially benefits homeowners and retirees. Social Security income is not taxed.

A single person may spend around $34,000/year, versus the national average of $40,000, mostly due to cheaper rent and utilities.

A family of four might need about $62,635/year to cover basic needs, compared to $68,800 nationally, a saving of over $6,000/year, according to World Population Review.

The state is particularly retiree-friendly, with no Social Security tax, low housing costs, and moderate healthcare expenses, making it 10–15% cheaper for those on fixed incomes.

2. Mississippi

| Category | Mississippi | U.S. Average |

|---|---|---|

| Overall Cost of Living | 83.3–87.9 (12–17% below average) | 100 |

| Housing Index | 66.3–73.9 (~26–34% cheaper) | 100 |

| Median Home Value | $140,000–$170,000 | ~$340,200 |

| Median Rent (2BR) | $991–$1,450/month | $1,154–$2,000/month |

| Grocery Index | 92.2 (~8% below) | 100 |

| Utilities Index | 90.4 (~9–10% below) | 100 |

| Healthcare Index | 94.7 (~5% below) | 100 |

| Transportation Index | 86.7 (~13% below) | 100 |

| State Income Tax | Flat 5% (retirement income exempt) | Varies by state |

| Sales Tax | 7% (groceries taxed lower) | Avg ~7.3% |

| Property Tax Rate | ~0.65% (low) | ~1.10% |

| Individual Annual Cost | ~$29,000/year | ~$35,000/year |

| Family of 4 Living Wage | ~$80,523/year | ~$86,000+ |

| Median Household Income | ~$70,656 | ~$74,580 |

| Retiree Benefits | No tax on retirement income; low housing costs | Varies – often taxed |

Mississippi remains one of the most affordable states in the U.S. In 2025, its cost of living index ranges between 83.3 and 87.9, placing it 12% to 17% below the national average.

This affordability is largely driven by extremely low housing and transportation costs.

Housing is the cheapest in the country, with a housing index of 66–74.

Median home prices range from $140,000 to $170,000, and rent for a two-bedroom apartment averages $991–$1,450, both well below national norms, according to Centex Homes.

This makes the state especially attractive to first-time buyers, renters, and families.

Groceries in Mississippi are about 8% cheaper than the U.S. average (index ~92.2), and utilities are roughly 9–10% lower, with monthly bills estimated around $330 according to Rent Cafe.

Healthcare costs are modest, too, with an index of 94.7, translating to savings on doctor visits and medical services.

Transportation is where residents see the biggest savings. Mississippi ranks lowest in the nation, with an index of 86.7, thanks to low fuel prices and short commutes.

The tax structure is also favorable. The state has a flat 5% income tax, low property taxes (0.65%), and no tax on retirement income, including Social Security, pensions, and IRAs, especially beneficial for retirees.

A single adult can live comfortably on about $29,000/year, nearly $6,000 less than the national average.

Though Mississippi’s median household income (~$70,656) is among the lowest, lower living costs help offset this.

A family of four needs about $80,523/year, but reduced expenses on housing, groceries, and transportation ease the burden.

Retirees are drawn to Mississippi for its low taxes, affordable housing, and manageable healthcare costs.

A couple living on a fixed income can stretch their savings much further here than in more expensive states.

3. Oklahoma

| Category | Oklahoma | U.S. Average |

|---|---|---|

| Overall Cost of Living | 85.7 (≈14% below average) | 100 |

| Housing Index | 68.6 (~31% below) | 100 |

| Median Home Value | $208,600 | ~$340,200 |

| Median Rent (2BR) | ~$1,400/month | ~$2,000/month |

| Grocery Index | 95.4 (~4.6% below) | 100 |

| Utilities Index | 95.4 (~5% below) | 100 |

| Healthcare Index | 96.6 (~3–4% below) | 100 |

| Transportation Index | 90.7 (~9% below) | 100 |

| State Income Tax | Progressive, top rate 4.75% | Varies |

| Sales Tax | Avg ~8.9% (state + local) | Avg ~7.3% |

| Property Tax Rate | ~0.97% (moderate-low) | ~1.10% |

| Individual Annual Cost | ~$31,200/year | ~$36,000/year |

| Family of 4 Living Wage | ~$89,000/year | ~$93,000+ |

| Median Household Income | ~$92,980 | ~$74,580 |

| Retiree Benefits | No tax on Social Security, pension exclusion | Varies by state |

Oklahoma ranks among the top three most affordable states in 2025, with a cost of living roughly 13–14% below the national average.

The state’s standout savings come from low housing costs, with a housing index of 68.6 and a median home price of $208,600 according to Oregon State University.

Rent is also affordable, about $1,400/month for a 2-bedroom apartment, far less than the U.S. norm.

Groceries and utilities are each about 5% cheaper, easing monthly expenses. Healthcare and transportation are also more affordable, with indices of 96.6 and 90.7, respectively. Gas prices, insurance, and medical care all cost less than national averages.

✅ Simplify taxes. ✅ Grow Oklahoma jobs.

Oklahoma’s personal income tax isn’t attracting business to our state, but we can fix this by replacing tax brackets with a flat income tax rate. Fair taxation regardless of earnings will boost the economy by rewarding success.🙌 pic.twitter.com/ckvmN6Krzj

— State Chamber of Oklahoma (@okstatechamber) February 24, 2025

Oklahoma’s tax structure includes a top income tax rate of 4.75%, moderate property taxes (~0.97%), and exemptions on Social Security and pensions, which are beneficial for retirees.

A single person can live comfortably on around $31,200/year, while a family of four needs about $89,000/year to cover living costs, well aligned with Oklahoma’s median household income of ~$92,980.

Low unemployment and lower costs of essentials like food, housing, and transportation make the state budget-friendly for working families.

For retirees, Oklahoma offers affordability, low taxes, and accessible healthcare, making it a great choice for those living on fixed incomes.

4. Kansas

| Category | Kansas | U.S. Average |

|---|---|---|

| Overall Cost of Living | 87.0 (≈13% below average) | 100 |

| Housing Index | 72.4 (~28% below) | 100 |

| Median Home Value | ~$243,200 | ~$340,200 |

| Median Rent (2BR) | ~$995–$1,215/month | ~$2,000/month |

| Grocery Index | 91.7 (~8% below) | 100 |

| Utilities Index | 100.2 (on par) | 100 |

| Healthcare Index | 100.4 (on par) | 100 |

| Transportation Index | 97.3 (~3% below) | 100 |

| State Income Tax | Progressive, top rate 5.7% | Varies |

| Sales Tax | Avg ~8.7% (state + local) | Avg ~7.3% |

| Property Tax Rate | ~1.14% (higher) | ~1.10% |

| Individual Annual Cost | ~$36,000/year | ~$40,000/year |

| Family of 4 Living Wage | ~$89,353/year | ~$93,000+ |

| Median Household Income | ~$92,980 | ~$74,580 |

| Retiree Benefits | Taxes SS (unless income < $75k), partial pension exemptions | Varies by state |

Kansas ranks among the top five most affordable states in 2025, with a cost of living about 13% below the national average. Its strengths lie in low housing and grocery costs, while utilities and healthcare sit around national norms.

Housing is highly affordable, with a housing index of 72.4. The median home value is about $243,200, though homes in smaller towns can be well below that. Median rent for a 2-bedroom ranges from $995 to $1,215, making Kansas an accessible state for both buyers and renters.

Groceries are about 8% cheaper than average (index 91.7), thanks in part to Kansas’s strong agricultural base. Utilities and healthcare are roughly on par with national costs, which families and retirees should budget for, especially with Kansas’s climate extremes that can affect energy use.

Transportation costs are slightly below average (index 97.3), with modest gas prices and shorter, less congested commutes.

View this post on Instagram

Taxes are mixed: Kansas has a progressive income tax topping out at 5.7%, sales tax averages 8.7%, and property taxes are relatively high (1.14%) according to Tax Foundation. Retirees should note that Social Security is taxed for those earning over $75,000, and 401 (k)/IRA withdrawals are also taxed, though some pension income is excluded.

For individuals, Kansas offers a manageable lifestyle, especially in smaller towns where rents can be as low as $800. A single person might need around $3,000/month for a comfortable life, up to 15% less than in many U.S. cities.

Families benefit from affordable homes, groceries, and local resources like parks and schools. A family of four’s estimated living wage (~$89,353) is nearly matched by the median family income (~$92,980), meaning many households can meet expenses without financial strain. Childcare and entertainment costs are also generally lower than national averages.

Retirees appreciate Kansas’s low housing and everyday costs, though the tax structure is less favorable. That said, a retirement income of $50,000 in Kansas may go as far as $60,000+ elsewhere due to lower food, housing, and transportation expenses.

5. Alabama

| Category | Alabama | U.S. Average |

|---|---|---|

| Overall Cost of Living | 88.0 (≈12% below average) | 100 |

| Housing Index | 70.1 (~30% below) | 100 |

| Median Home Value | ~$216,600 | ~$340,200 |

| Median Rent (2BR) | ~$1,445/month | ~$2,000/month |

| Grocery Index | 98.2 (~2% below) | 100 |

| Utilities Index | 100.7 (~0.7% above) | 100 |

| Healthcare Index | 91.2 (~9% below) | 100 |

| Transportation Index | 92.7 (~7.3% below) | 100 |

| State Income Tax | Up to 5% (low brackets, SS exempt) | Varies |

| Sales Tax | Avg 9–10% (state + local) | Avg ~7.3% |

| Property Tax Rate | ~0.39% (2nd lowest nationally) | ~1.10% |

| Individual Annual Cost | ~$35,000/year | ~$40,000/year |

| Family of 4 Living Wage | ~$85,000/year | ~$93,000+ |

| Median Household Income | ~$62,000 | ~$74,580 |

| Retiree Benefits | No tax on SS/pensions, very low property tax | Varies by state |

Alabama ranks among the most affordable states in 2025, with a cost of living about 12% below the national average. The state is especially known for cheap housing, low property taxes, and affordable healthcare and transportation.

Housing is a major advantage in Alabama. With a housing index of 70.1, homes cost about 30% less than the national average, as noted by ACRE. The median home price is $216,600, and rent for a 2-bedroom averages around $1,445/month. In smaller towns like Florence, costs are even lower, making homeownership highly attainable.

Groceries are roughly 2% below average, while utilities run just slightly above national norms due to high A/C use in the summer. Healthcare, however, is one of the state’s biggest cost savers, with an index of 91.2; medical care is about 9% cheaper, which benefits both families and retirees.

Transportation is also budget-friendly (index 92.7), with low gas prices and modest car-related expenses. While public transit is limited, driving is affordable, even over long distances.

Alabama’s tax structure is another strength. Property tax is only 0.39%, the second-lowest in the country. A $217k home might see just $850/year in property taxes. The income tax tops out at 5%, but Social Security and most retirement income are exempt. Sales tax, however, is high, averaging 9–10%, and it applies to groceries, though that may change in the future.

For individuals, living independently in Alabama is manageable on a modest income. Rent is low in most towns, and with overall costs ~11% below national levels, a single person earning $35,000/year can live as well as someone making $40,000 elsewhere.

Families benefit from low housing and healthcare expenses. A family of four may spend ~11% less annually than the U.S. average. While Alabama’s median household income (~$62k) is lower than the national median, the reduced costs allow families to live comfortably, especially with affordable homes, free outdoor recreation, and lower-than-average childcare costs in many areas.

For retirees, Alabama is a standout. No tax on Social Security, very low property taxes, and cheap healthcare make the state one of the best for those on fixed incomes. A retired couple could maintain the same lifestyle on $45,000/year in Alabama which might require $55,000 or more elsewhere.

6. Arkansas

| Category | Arkansas | U.S. Average |

|---|---|---|

| Overall Cost of Living | 88.7 (≈11% below average) | 100 |

| Housing Index | 74.8 (~25% below) | 100 |

| Median Home Value | ~$195,700 | ~$340,200 |

| Median Rent (2BR) | ~$1,375/month | ~$2,000/month |

| Grocery Index | 95.2 (~5% below) | 100 |

| Utilities Index | 90.7 (~9.3% below) | 100 |

| Healthcare Index | 85.7 (~14% below) | 100 |

| Transportation Index | 90.0 (~10% below) | 100 |

| State Income Tax | Top rate ~4.7%, SS/pension partly exempt | Varies |

| Sales Tax | Avg ~9.5% (high) | Avg ~7.3% |

| Property Tax Rate | ~0.61% (low) | ~1.10% |

| Individual Annual Cost | ~$32,000/year | ~$36,000–$40,000/year |

| Family of 4 Living Wage | ~$50,000–$55,000/year | ~$60,000+ |

| Median Household Income | ~$58,700 | ~$74,580 |

| Retiree Benefits | No tax on SS, $6,000 pension exemption, and homestead credit | Varies |

Arkansas ranks as one of the most affordable states in the U.S., with a cost of living around 11% below the national average. Some federal data places it even lower, making it a consistent top contender for low-cost living.

Housing is extremely affordable, with a housing index of 74.8. The median home value is just $195,700, and rent averages around $1,375/month for a 2-bedroom, well below national averages, according to Arkansas EDC.

Groceries are roughly 5% cheaper than the national average (index 95.2), while utilities are nearly 9% cheaper, with the average monthly bill around $335. Healthcare is where Arkansas really shines; costs are among the lowest in the country, at about 14% under the national average (index 85.7). This makes it especially attractive for retirees and those with ongoing medical needs.

Transportation is also budget-friendly (index 90.0), with cheap gas and car insurance. While the state is car-dependent due to its rural nature, the overall costs of owning and operating a vehicle are low.

@thenextgenbusiness Cost of Living in Arkansas #arkansas #democrat #republican #salary ♬ original sound – The Next Gen Business

Taxes in Arkansas are moderate. The state income tax tops out at around 4.7%, and while the sales tax averages 9.5%, groceries are taxed at a lower rate (1.5%) according to DFA.

Property taxes are low, with an effective rate of 0.61%, and most homeowners receive a $375 homestead tax credit annually. Social Security is tax-exempt, and retirees can deduct up to $6,000 in other retirement income, making Arkansas tax-friendly for seniors.

For individuals, Arkansas is ideal for stretching a modest income. Rent in small towns can be under $800, and with total costs ~11% below the U.S. average, someone who needs $3,000/month elsewhere might live well on ~$2,650/month in Arkansas.

Families also benefit from low costs. A family of four may live comfortably on $50,000–$55,000/year, compared to $60,000+ in most states. The state’s low housing, utility, and healthcare costs mean families don’t need high incomes to maintain a good lifestyle, even though the median household income is ~$58,700.

Retirees often choose Arkansas for its blend of low housing, tax breaks, and very cheap healthcare according to NEAMB. Many seniors can buy homes outright or take on manageable mortgages. Arkansas’s cost of living allows a retirement income of $45,000 to feel like $55,000–$60,000 elsewhere.

7. Missouri

| Category | Missouri | U.S. Average |

|---|---|---|

| Overall Cost of Living | 88.7 (≈11% below average) | 100 |

| Housing Index | 77.8 (~22% below) | 100 |

| Median Home Value | ~$233,600 | ~$340,200 |

| Median Rent (2BR) | ~$1,300/month | ~$2,000/month |

| Grocery Index | 96.0 (~4% below) | 100 |

| Utilities Index | 98.8 (~1.2% below) | 100 |

| Healthcare Index | 91.8 (~8.2% below) | 100 |

| Transportation Index | 87.2 (~13% below) | 100 |

| State Income Tax | Top rate 4.95%, SS exempt (with limits) | Varies |

| Sales Tax | Avg ~8.25% (state + local) | Avg ~7.3% |

| Property Tax Rate | ~0.73% (moderate) | ~1.10% |

| Individual Annual Cost | ~$44,000/year | ~$50,000/year |

| Family of 4 Living Wage | ~$88,000/year | ~$93,000+ |

| Median Household Income | ~$68,545 | ~$74,580 |

| Retiree Benefits | SS & partial pension exemptions, property tax credit | Varies |

Missouri is among the most affordable states in the U.S., with a cost of living around 11% below the national average. It combines the best of Midwestern and Southern affordability, offering low housing, transportation, and healthcare costs as noted by MERIC.

Housing is a key savings point, with a housing index of 77.8. The median home price is $233,600, and rent for a 2-bedroom apartment is about $1,300/month, compared to $2,000 nationally. While urban areas like Kansas City are a bit more expensive, smaller cities and rural areas are especially budget-friendly.

Groceries and utilities are close to average, with indices of 96.0 and 98.8, respectively. Healthcare, however, is more affordable, about 8% below the national average, supported by large, competitive hospital systems.

Transportation is a standout category with an index of 87.2. Missouri has some of the lowest gas prices and car ownership costs in the country. A typical household could save over $1,000 per year on driving-related expenses, according to APTA.

Missouri has a graduated income tax with a top rate of 4.95%, sales tax averaging 8.25%, and moderate property taxes (~0.73%) as noted by AARP. Social Security income is exempt (with limits), and partial pension exemptions are available. Seniors may also qualify for a property tax credit (Circuit Breaker).

For individuals, Missouri provides a manageable cost of living. Someone earning $44,000/year can afford what would take $50k in an average state. Affordable rent, gas, and healthcare stretch incomes further, especially for singles living in smaller cities or mid-sized metros like St. Louis.

A 4-bedroom home may cost $250k–$300k, allowing families to own comfortably even on a moderate income. With an estimated living wage of ~$88,000 for a family of four and a median household income near $68,500, families enjoy reasonable costs for housing, food, and utilities, even with average childcare expenses.

Retirees find Missouri a great mix of low costs and solid amenities, according to Travel Leisure. Housing is affordable, healthcare costs are modest, and retirement income is partially exempt from state tax.

A retiree couple living on $50,000/year can expect a comfortable lifestyle, with money left for leisure thanks to cheap fuel, low housing costs, and numerous low-cost outdoor and community activities. Missouri’s balanced affordability and moderate tax structure make it a smart pick for budget-conscious retirees.

8. Iowa

| Category | Iowa | U.S. Average |

|---|---|---|

| Overall Cost of Living | 89.7 (≈10% below average) | 100 |

| Housing Index | 74.8 (~25% below) | 100 |

| Median Home Value | ~$213,300 | ~$340,200 |

| Median Rent (2BR) | ~$1,100/month | ~$2,000/month |

| Grocery Index | 96.6 (~3.4% below) | 100 |

| Utilities Index | 92.9 (~7.1% below) | 100 |

| Healthcare Index | 95.8 (~4.2% below) | 100 |

| Transportation Index | 97.6 (~2.4% below) | 100 |

| State Income Tax | 6% in 2025, flat 3.9% by 2026 | Varies |

| Sales Tax | Avg ~7% (state + local) | Avg ~7.3% |

| Property Tax Rate | ~1.43% (higher than average) | ~1.10% |

| Individual Annual Cost | ~$36,000/year | ~$40,000/year |

| Family of 4 Living Wage | ~$70,000–$75,000/year | ~$93,000+ |

| Median Household Income | ~$71,433 | ~$74,580 |

| Retiree Benefits | No tax on SS or retirement (55+), some property relief | Varies |

Iowa offers a cost of living about 10% below the national average, making it one of the most affordable states relative to income. The state combines low housing and utility costs with high median incomes, especially in areas like Des Moines, which is nearly 14% below the U.S. average on its own, according to Common Sense Institute.

Housing is highly affordable, with a housing index of 74.8 and a median home value of $213,300. Rent is also budget-friendly, averaging $1,100 for a 2-bedroom, allowing both homeowners and renters to live comfortably even on modest incomes.

Groceries and utilities are slightly below average, and healthcare is about 4% cheaper than the U.S. norm, supported by high-quality medical facilities. Transportation costs are also slightly lower, even though long rural drives are common, thanks to cheap gas and low congestion.

In 2025, the income tax tops out at 6%, but the state is transitioning to a flat 3.9% rate by 2026. Sales tax is reasonable (~7% total), but property taxes are higher than average (~1.43%). Still, Social Security and retirement income are now tax-exempt for those 55+, helping older residents significantly.

For individuals, Iowa is a great place to stretch a salary. Someone earning $40k annually can live similarly to someone earning $45k in a more expensive state, thanks to cheap rent, healthcare, and groceries. Low unemployment (~3.2%) and affordable living make Iowa especially appealing for young professionals or single retirees.

The median household income ($71k) closely matches the cost of living for a family of four, and essentials like housing, food, and education are affordable. Public schools are well-regarded and safe, and community-based cities mean families often avoid added costs like private tuition or added security.

Retirees benefit from low housing, zero tax on Social Security and retirement income (for 55+), and very manageable medical costs. Even with slightly high property taxes, Iowa offers strong value.

A retired couple living on $50,000/year would feel like they have $55,000+ in purchasing power due to the state’s lower prices. Iowa’s calm pace, low crime, and community spirit make it ideal for those seeking a quiet and cost-effective retirement, especially in charming towns or near mid-sized cities like Cedar Rapids or Iowa City.

9. Tennessee

| Category | Tennessee | U.S. Average |

|---|---|---|

| Overall Cost of Living | 90.5 (≈9.5% below average) | 100 |

| Housing Index | 83.2 (~17% below) | 100 |

| Median Home Value | ~$307,300 | ~$340,200 |

| Median Rent (2BR) | ~$1,750/month | ~$2,000/month |

| Grocery Index | 97.1 (~2.9% below) | 100 |

| Utilities Index | 87.2 (~13% below) | 100 |

| Healthcare Index | 88.6 (~11.4% below) | 100 |

| Transportation Index | 89.1 (~10.9% below) | 100 |

| State Income Tax | None (0%) | Varies |

| Sales Tax | Avg ~9.55% (highest in U.S.) | Avg ~7.3% |

| Property Tax Rate | ~0.66% (15th-lowest) | ~1.10% |

| Individual Annual Cost | ~$45,000/year | ~$50,000/year |

| Family of 4 Living Wage | ~$80,000/year | ~$93,000+ |

| Median Household Income | ~$65,000–$68,000 | ~$74,580 |

| Retiree Benefits | No tax on SS or retirement income | Varies |

Tennessee has a cost of living about 9.5% below the U.S. average, making it one of the more affordable states, according to UTK news. It offers moderate housing prices, low utility and healthcare costs, and a tax-friendly environment, especially appealing to individuals, families, and retirees alike.

Housing is relatively affordable, with a housing index of 83.2. The median home price is ~$307,300, slightly under the national median, and rent averages $1,750 for a 2-bedroom. Nashville is more expensive, nearly at national cost levels, but cities like Knoxville and Memphis offer housing 13% below average, and many towns have homes in the $200k range or cheaper.

Utilities and healthcare are notably affordable, with utility costs 13% below average and healthcare about 11% below. Despite Tennessee’s hot summers, energy bills remain low, largely due to TVA-supplied electricity. Healthcare savings stem from a competitive provider market and low medical labor costs.

Groceries and transportation are both slightly under average. Gas and car ownership costs are low. Tennessee doesn’t require car safety inspections, which saves residents even more. Sales tax is high (~9.55%), but no income tax balances that out, allowing most people to keep more of their paycheck, according to gov sources.

For individuals, Tennessee offers strong value. Without income tax, a salary of $45,000 goes further than in most states. Renting in Memphis or Knoxville is often under $1,100/month, and utilities are low. Even in pricier Nashville, living is manageable due to the lack of income tax and the potential for shared housing.

Families benefit from lower housing, healthcare, and childcare costs (especially outside the metro hubs). A family earning $80,000 in Tennessee might live as comfortably as one earning $90,000 elsewhere. Public education is affordable, and college tuition is low for in-state students.

Retirees especially enjoy Tennessee’s advantages: no income tax, including on Social Security and retirement income, low property taxes, and some of the lowest utility and healthcare costs in the nation.

Retiring on a fixed income is far more sustainable here, particularly in areas like Eastern Tennessee (e.g., Knoxville or the Smoky Mountains), which offer a mix of scenic living and affordability. A $40,000 annual retirement income in Tennessee may feel like $50,000 in a higher-cost state.

The Bottom Line

Whether it’s the incredibly low housing prices in West Virginia and Mississippi, the tax-free income of Tennessee, or the healthcare savings in Arkansas and Alabama, each state offers its own version of financial freedom. Families can afford homes with yards, individuals can build savings, and retirees can enjoy their golden years without constant money stress.

Of course, no place is perfect. You’ll want to weigh your lifestyle preferences. Do you want warm weather, walkable towns, or access to top-notch hospitals? But if stretching your dollar is a top priority, these are the states to watch.

If I had to choose right now? I think I’d pick Arkansas.

Why? It’s not the flashiest state, but it quietly checks every box: very low cost of living, incredibly cheap healthcare, affordable housing, and a peaceful, nature-filled lifestyle. The Ozarks, the lakes, the slower pace…

I can picture myself in a little house with a view, no mortgage, low taxes, and a nearby farmers’ market. Plus, $45,000 a year there feels like $60,000 almost anywhere else. That’s not just surviving, that’s living well.