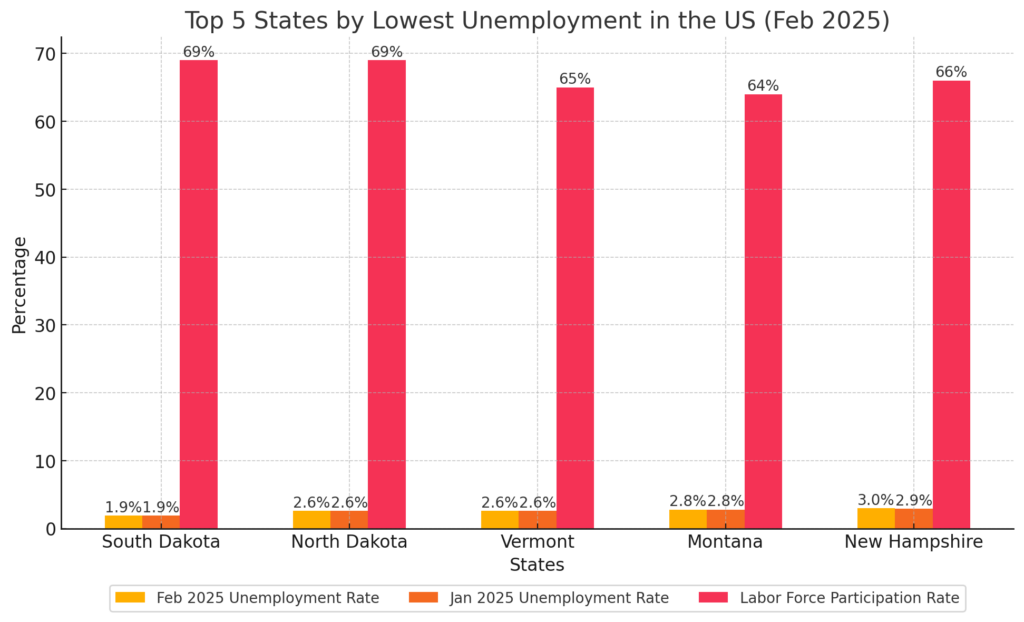

As of early 2025, five US states are outperforming the national job market with the lowest unemployment rates in the country, significantly below the national average of 4.1%.

Leading the nation is South Dakota, with an exceptionally low jobless rate of 1.9%, followed by North Dakota and Vermont, each at 2.6%. Montana (2.8%) and New Hampshire (3.0%) complete the top five.

These states share key characteristics: strong, diversified industries; high labor force participation rates; and economic policies that support job creation and retention.

This report provides a detailed, data-driven overview of each state’s employment landscape, highlighting the economic conditions and sectors driving these historically low unemployment levels.

1. South Dakota – Lowest Unemployment in the Nation

South Dakota boasts the lowest unemployment rate in the country, holding steady at just 1.9% through the beginning of 2025, according to kfyrtv.com. This rate has remained unchanged for several months, reflecting an extremely tight labor market.

Virtually everyone who wants a job can find one in South Dakota, and the state’s jobless rate sits far below the U.S. average. Key factors include a high labor force participation, a diverse economy led by agriculture, and a growing financial services sector.

South Dakota Employment Snapshot

| Unemployment Rate | 1.9% – Lowest in U.S. (vs. 4.0% U.S. average) |

| Unemployment Rate | 1.9% – No change (stable from January) |

| Labor Force Participation | ~68.7% (among the highest in the nation) |

| Major Industries | Agriculture (livestock, corn), Financial Services (banking), Tourism, Manufacturing |

| Notable Economic Factors | No state income tax; low business costs; consistent job growth and quick reemployment |

South Dakota’s labor force participation rate is about 68-69%, one of the highest in the U.S., as noted by BLS.

Several industries drive South Dakota’s economy and help keep unemployment low.

Agriculture is a foundation – the state is a major producer of cattle, corn, soybeans, and wheat.

Additionally, South Dakota has cultivated a financial services hub in Sioux Falls (with major credit card and banking operations), leveraging the state’s business-friendly tax environment (no corporate or personal income tax) to attract employers.

Tourism is another pillar – attractions like Mount Rushmore and Badlands National Park draw visitors and support jobs in hospitality. Other significant sectors include manufacturing (e.g., food processing and farm equipment) and healthcare.

Recent data show broad job growth across South Dakota’s sectors, helping absorb job seekers. For example, construction employment in early 2025 was up ~5-6% year-over-year, and healthcare jobs grew ~3%.

State officials note that even with such a low jobless rate, South Dakotans are finding new jobs quickly if they do become unemployed – the duration of unemployment remains near historic lows factors also play a role.

South Dakota’s longstanding low-tax, pro-business policies make it attractive for companies and startups. The absence of state income tax and relatively low regulations encourages business expansion and new investments.

One challenge of such a low unemployment rate is a tight labor supply – employers may struggle to find workers, and some are raising wages or improving benefits to attract and retain staff. Indeed, South Dakota’s 1.9% unemployment is so low that economists warn of potential labor shortages if businesses expand too fast, as noted by the Tax Foundation.

2. North Dakota – Energy-Driven Employment Strength

North Dakota has the second-lowest unemployment rate in early 2025, at 2.6% as of January-February. Like its southern neighbor, North Dakota’s jobless rate is far below the national level.

The state did see a very slight uptick (+0.1 percentage point) from late 2024 into January 2025, but it remains firmly among the lowest in the country, as noted by jec.senate.gov. North Dakota benefits from a robust energy and agriculture sector, coupled with high workforce participation that keeps its labor market tight.

North Dakota Employment Snapshot

| Unemployment Rate | 2.6% – Near historic low (up 0.1 ppt from Dec) |

| Unemployment Rate | 2.6% – Stable (no change from Jan) |

| Labor Force Participation | ~69.4% (among the highest, ranked #2 in U.S.) |

| Major Industries | Oil & Gas Extraction, Agriculture (wheat, corn), Manufacturing, Technology Services, Government (including military) |

| Notable Economic Factors | Energy boom (Bakken oil fields); low cost of living; workforce programs to address skilled labor needs |

This has kept unemployment low, even though the state’s jobless rate ticked up slightly from a year ago (it was about 2.2% in Jan 2024). The labor force participation in North Dakota is about 69%, one of the highest in the nation.

Key industries in North Dakota span traditional sectors like energy and agriculture as well as emerging fields. Oil and natural gas extraction is a major employer and contributor to the state’s GDP; fluctuations in oil prices can influence employment, but as of early 2025, the sector remains strong.

Agriculture is another backbone – North Dakota is a top producer of wheat, soybeans, and other grains, which sustains many farming and agri-business jobs. Manufacturing has a presence (for example, farm equipment and food processing plants), and tech-enabled services are growing in cities like Fargo.

Additionally, government and military employment is significant – the state hosts Air Force bases and other federal facilities. North Dakota’s economy has been growing and diversifying, which helps explain its low unemployment.

Even as some sectors saw small job losses, others expanded. In January 2025, North Dakota did experience a net loss of about 1,600 payroll jobs (notably in a few sectors, like possibly retail or hospitality, after the holidays), leading to a slight uptick in the unemployment rate to 2.6%.

State officials highlight that workforce participation remains very high, and the state labor force even grew slightly, suggesting people continue to be drawn into work as jobs become available. Notable economic characteristics of North Dakota include its relatively low taxes and business-friendly environment (though it does have an income tax, it’s modest).

The state has used revenues from the oil boom to establish funds and invest in infrastructure, aiming to create a stable business climate. There are ongoing workforce development initiatives to train workers in skilled trades and energy jobs, helping keep unemployment low by matching workers to in-demand fields.

One outcome of the tight labor market is that North Dakota, like other low-unemployment states, faces worker shortages in certain industries – for instance, tech companies and healthcare providers sometimes struggle to recruit enough talent locally.

Overall, North Dakota’s energy-driven growth and high labor force engagement have translated into one of the nation’s lowest unemployment rates, a trend expected to continue into 2025 barring major shifts in commodity prices or economic conditions.

3. Vermont – Consistently Low Jobless Rate in New England

Vermont stands out as New England’s top performer in terms of low unemployment, with a 2.6% unemployment rate in early 2025. This small state has consistently low jobless figures, thanks in part to its mix of stable industries (like education, government, and tourism) and a well-educated workforce.

The state did see a slight rise in unemployment from a year ago (it was about 2.0% in early 2024), but at 2.6% it remains well below the U.S. average.

Vermont Employment Snapshot (Jan-Apr 2025)

| Unemployment Rate | 2.6% – up slightly (+0.1 ppt) from Dec |

| Unemployment Rate | 2.6% – Holding steady (no change from Jan) |

| Labor Force Participation | ~65.5% (seasonally adjusted, Jan 2025) |

| Major Industries | Education & Healthcare, Tourism (ski resorts), Manufacturing (semiconductors, specialty foods), Agriculture (dairy), Government |

| Notable Economic Factors | High educational attainment, state programs for re-employment, a small labor force with worker shortages in some fields |

The state’s labor force participation rate is about 65-66%, a bit above the national average. Vermont’s labor force is essentially flat to slightly growing – for example, in January 2025, the number of employed Vermonters increased by 113, and unemployed persons increased by 75, compared to the prior month, according to worldpopulationreview.com.

Several industries anchor Vermont’s economy and help keep unemployment low. Education and healthcare a top sectors – Vermont has many jobs in hospitals, clinics, and educational institutions (from public schools to universities like UVM).

Tourism is vital as well; Vermont’s ski resorts, fall foliage season, and summer outdoor recreation attract visitors and support employment in leisure and hospitality. (Even in the quieter months, many tourism-related businesses retain core staff, contributing to low off-season unemployment.)

Manufacturing in Vermont, while smaller than in many states, includes high-value niches – for example, semiconductor and electronics manufacturing around Burlington, as well as specialty foods (Vermont is known for ice cream, cheese, and craft beverages).

Agriculture (especially dairy farming and maple syrup production) remains an important employer in rural areas. Government jobs (state agencies, local government, etc.) also constitute a significant share of employment in the capital, Montpelier, and elsewhere.

One notable aspect is how quickly unemployed Vermonters find jobs. According to the Vermont Department of Labor, the average duration of unemployment in the state is near historic lows, meaning most job seekers are re-employed relatively quickly.

This speaks to the efficient matching of workers to job openings – likely a result of both an effective reemployment system and the high demand for labor. Even with the low unemployment rate, Vermont’s employers in certain industries face persistent labor shortages.

For instance, the healthcare sector needs more nurses and caregivers, and ski resorts often report difficulty hiring enough seasonal workers. The state’s small population (and slow population growth) inherently limits the labor pool, which keeps unemployment low but can constrain growth.

Economic policies and characteristics in Vermont also influence its labor market. Vermont has a high rate of educational attainment, which tends to improve employment prospects. The state offers workforce training and job placement programs, and it actively encourages labor force participation through various initiatives.

It’s worth noting that Vermont’s tax burden is relatively high (compared to the Dakotas, for example), but that has not prevented the state from achieving low unemployment, suggesting that the demand for labor (especially in essential services and tourism) is strong enough to employ nearly all who seek work.

Vermont’s unemployment rate has risen from 2.0% to 2.6% over the past year, as noted by aem-prod.oklahoma.gov.

Overall, Vermont’s combination of stable public-sector employment, year-round tourism, and a highly engaged workforce has kept its unemployment among the lowest in the nation.

4. Montana – Booming Economy with Falling Unemployment

At 2.8%, Montana’s unemployment rate is the fourth-lowest in the country as of early 2025. Uniquely, Montana is one of the only states that reduced its unemployment rate over the past year, bucking the national trend of modest increases.

In February 2025, Montana’s jobless rate was down 0.2 percentage points from a year earlier, the only state with a year-over-year decline, according to bls. This improvement reflects Montana’s strong, expanding economy, bolstered by an influx of new residents, a surge in construction, and pro-growth policies in recent years.

Montana Employment Snapshot

| Unemployment Rate | 2.8% – Down from ~3.0% a year ago |

| Unemployment Rate | 2.8% – Multi-year low (lowest since 2023) |

| Labor Force Participation | ~63-64% (about 63.6% in recent estimates) |

| Major Industries | Natural Resources & Mining (incl. oil, coal), Tourism (national parks), Agriculture (cattle, wheat), Construction, Tech/Professional Services |

In practical terms, 2.8% unemployment means Montana’s labor market is extremely tight – only a small fraction of the workforce is unemployed, and those tend to find jobs relatively quickly.

Over the last year, Montana added jobs and grew its labor force simultaneously. The labor force reached a record high (around 579,000 workers in 2024, +0.8% year-over-year) according to News.mt., indicating that more people are moving to or entering the workforce in Montana, yet unemployment still fell – a sign of strong job creation.

Several forces are driving Montana’s success. Migration is one: Montana has attracted new residents in recent years (drawn by its quality of life and remote work opportunities), which has expanded the labor pool in areas like Bozeman and Missoula.

These growing communities have thriving technology and professional services sectors (for example, startups and telecommuters), adding to job growth. At the same time, traditional sectors remain key employers.

Tourism is huge – Montana is home to Glacier National Park and half of Yellowstone National Park, along with skiing and outdoor recreation industries. This fuels jobs in leisure and hospitality (though that sector can be seasonal).

Natural resources and mining are significant as well; Montana produces oil, coal, metals, and timber. Higher energy and commodity prices in the last couple of years have kept mining and drilling activity robust, sustaining jobs.

Agriculture (particularly cattle ranching and wheat farming) is another staple industry supporting rural employment. Additionally, a construction boom has been underway – the state has had to build more housing and infrastructure to accommodate growth, and mining projects have also driven construction hiring.

In early 2025, Montana saw job gains in construction, transportation, and trade, even as some seasonal jobs in hospitality dipped after the holidays Montana’s state policies have been cited as contributors to its low unemployment.

The current administration emphasizes a “pro-jobs, pro-family agenda” – cutting red tape, lowering taxes, and otherwise making it easier for businesses to grow and hire. For example, the state reduced business equipment taxes and streamlined permitting processes.

Moreover, wage growth in Montana has been strong – roughly 5% year-over-year recently – which not only benefits workers but also attracts job seekers and encourages people to enter the labor force, according to wshu.org.

In fact, Montana reported that wage growth has outpaced inflation in the past four years, indicating real income gains that likely draw more people into employment. Montana’s labor force participation is around 63-64%, a bit lower than the national average.

Continued population growth and efforts to improve job training could raise that participation rate. A challenge Montana faces with such low unemployment is ensuring enough skilled workers for certain industries.

Some employers (from manufacturing to healthcare) report difficulty filling specialized positions. The state has responded with workforce training programs and initiatives to connect high school and college students with local employers.

Overall, the falling unemployment rate in early 2025 showcases a state economy firing on all cylinders – job growth outpacing even an expanding labor force, resulting in the lowest unemployment the state has seen in years.

5. New Hampshire – Robust Labor Market, Constrained by Workforce Size

New Hampshire rounds out the top five with an unemployment rate of about 2.9-3.0% in the first months of 2025. (New Hampshire’s rate was 2.9% in January and ticked up to 3.0% in February, seasonally adjusted.)

This state enjoys a healthy labor market with high demand for workers, which has kept unemployment very low. In fact, as one local economist put it, “it’s a good time to be a worker in New Hampshire” – nearly everyone who wants a job can find one.

The slight increase to 3.0% unemployment reflects a labor force that is growing a bit, but still not fast enough to meet employers’ needs.

New Hampshire Employment Snapshot (Jan-Apr 2025)

| Unemployment Rate | 2.9% – Very low (near record lows for NH) |

| Unemployment Rate | 3.0% – Slight uptick (+0.1 point from Jan) |

| Labor Force Participation | ~65.8% (well above U.S. average) |

| Major Industries | High-Tech Manufacturing (aerospace, electronics), Healthcare, Tourism (hospitality, recreation), Financial Services, Education & Government |

| Notable Economic Factors | No state income tax or sales tax; high median income; housing shortages limiting labor supply |

In practical terms, New Hampshire has essentially full employment – “just about everyone who wants a job can find one” in the state. The state’s labor force participation is approximately 65-66%, higher than the national level, reflecting an engaged workforce.

However, New Hampshire’s total labor force has not fully rebounded to its pre-pandemic peak; there are still “nearly 10,000 fewer employed residents in the state now than there were shortly before the pandemic,” which suggests a smaller pool of workers available relative to 2019.

The state has a strong manufacturing sector, particularly in high-tech and precision manufacturing (such as aerospace components, defense equipment, and electronics) – a legacy of being part of the greater Boston technology corridor.

Healthcare is another major employer, with several large hospitals and healthcare networks across the state. Tourism and hospitality are important, especially in the White Mountains and Lakes Region: skiing, hiking, and beach destinations (on the Seacoast) create many jobs in hotels, restaurants, and recreation.

Financial services and insurance companies have a presence in southern New Hampshire, taking advantage of the state’s tax advantages. Additionally, education and government provide stable employment (for example, the state government in Concord and universities like Dartmouth College, though Dartmouth’s workforce is partly in Vermont, it influences NH’s economy too).

One distinctive economic feature is New Hampshire’s tax structure – it has no state income tax and no general sales tax. This can attract businesses and workers (who enjoy higher take-home pay), potentially contributing to employment growth.

Indeed, New Hampshire consistently ranks high in business climate and median household income. However, an important challenge for New Hampshire is the housing market.

According to New Hampshire’s Economic and Labor Market Information Bureau, a housing crunch is holding back the state’s economy: high housing costs and limited availability make it difficult for new workers to move in and for employers to recruit from outside.

As the bureau’s director noted, this shortage of affordable housing “makes it more difficult for us to grow our labor force” via in-migration. In other words, there are plenty of jobs, but not enough people to fill them, in part because potential workers can’t easily find housing.

This state is also known for high alcohol consumption, among the highest in the world.

Comparison of the Top Five States

All five are well below the national unemployment rate, which was about 4.0% in Jan and 4.1% in Feb 2025.

These states also tend to have higher-than-average labor force participation, meaning a large share of their population is active in the job market. This combination of high labor engagement and low unemployment signifies very strong labor market conditions:

Top 5 States by Lowest Unemployment

(Sources: Bureau of Labor Statistics, Local *Area Unemployment Statistics; State labor force data. Unemployment rates are seasonally adjusted. Labor force participation rates are 2024-2025 estimates and rounded.) All five states have unemployment rates roughly 1 to 2 percentage points below the U.S. average.

(Sources: Bureau of Labor Statistics, Local *Area Unemployment Statistics; State labor force data. Unemployment rates are seasonally adjusted. Labor force participation rates are 2024-2025 estimates and rounded.) All five states have unemployment rates roughly 1 to 2 percentage points below the U.S. average.

South Dakota is the clear outlier on the low end, with under 2% unemployment. North Dakota and Vermont are next, both at 2.6%. Montana and New Hampshire follow at 2.8% and 3.0%, respectively.

It’s also evident that the Plains states (SD, ND) feature extremely high labor force participation (~69%), whereas Montana’s is a bit lower (low-60s %). New Hampshire and Vermont are in between, with mid-60s participation rates, which is still above the national figure (~62%).

High participation often correlates with strong economies, but even Montana, with a more average participation rate, has managed to achieve very low unemployment through job growth and immigration.

Another commonality is that each of these states has one or more strong industries propelling demand for labor: for example, energy in North Dakota; finance and agriculture in South Dakota; tourism and tech/education in Vermont and New Hampshire; and a broad natural resource and construction boom in Montana.

Conclusion

In summary, the five states with the lowest unemployment rates in Jan-Apr 2025 – South Dakota, North Dakota, Vermont, Montana, and New Hampshire – each demonstrate how a combination of healthy industry sectors, high labor force participation, and effective economic policies can yield extremely low jobless levels.

All five states have unemployment rates roughly 1.0-2.2 percentage points below the national rate, a gap that translates into thousands more people employed and contributing to their local economies.