If you are buying health insurance in 2025, where you live matters just as much as what plan you choose.

According to resources, the most affordable state for a Silver benchmark plan is New Hampshire, with average monthly premiums around $325, while the most expensive is Vermont, where the same plan averages $1,277.

That is nearly a $950 difference every month for the same type of coverage, depending only on the state of residence. Other affordable states include Minnesota, Maryland, and Virginia, while the priciest include Alaska, West Virginia, and Wyoming.

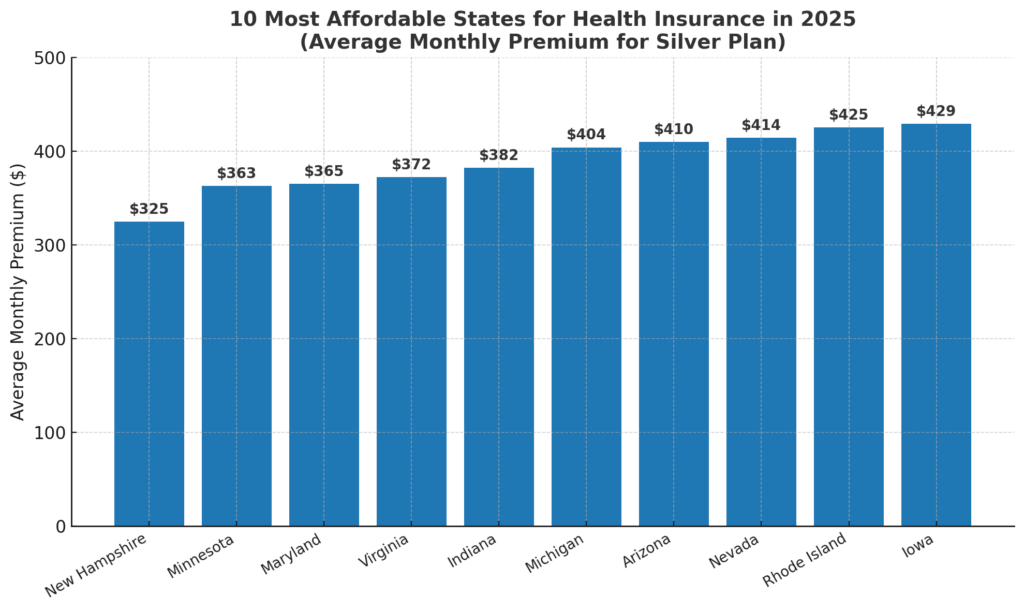

10 Most Affordable States for Health Insurance in 2025

The following table shows the states with the lowest average monthly premiums for a 40-year-old on a Silver benchmark plan, based on ACA Marketplace data.

According to PeopleKeep’s 2024–2025 insurance pricing analysis, these states have premiums well below the national average of around $477 per month for a Silver plan.

1. New Hampshire (~$325/month)

New Hampshire consistently leads as the cheapest state for ACA benchmark Silver plans. According to PeopleKeep, its average premium of around $325 is less than half the national average. The state benefits from strong competition among insurers, a relatively healthy population, and regulatory stability.

Unlike Vermont, its neighbor, New Hampshire has avoided significant insurer exits from the marketplace, keeping choices broad. Residents also benefit from active enrollment campaigns that keep the risk pool younger and healthier, which helps suppress premiums.

2. Minnesota (~$363/month)

Minnesota owes its affordability to two major policies: early Medicaid expansion and the establishment of MinnesotaCare, a state-funded program for low-income residents. This shifted thousands of high-risk individuals away from private insurance, lowering premiums for everyone else.

Minnesota also has a history of nonprofit insurers, such as HealthPartners and Medica, which are mission-driven rather than profit-maximizing, and this has contributed to stable, relatively low rates compared to much of the country.

3. Maryland (~$365/month)

Maryland’s premiums dropped significantly after it introduced a state reinsurance program in 2019, designed to absorb the costs of very high claims. According to the Maryland Health Benefit Exchange, premiums fell by more than 30% after implementation.

By 2025, this program will remain one of the most effective cost-control tools in the nation. Maryland also actively regulates hospital charges under its unique “all-payer” system, which keeps medical costs from spiraling, indirectly benefiting insurance buyers.

4. Virginia (~$372/month)

Virginia is notable because it was identified by MoneyGeek as the single cheapest state for a Silver plan in 2025, with premiums around $390. The state has attracted multiple national and regional insurers, which fuels competition.

Virginia also implemented its state-based exchange, “Virginia’s Insurance Marketplace,” in 2024, giving it more control over local pricing. Early data suggest that moving away from the federal Healthcare.gov system has already had stabilizing effects.

5. Indiana (~$382/month)

Indiana’s Healthy Indiana Plan, covering over 754,000 Hoosiers, could be at risk under a potential federal cost reduction under the incoming Trump administration. The state’s ‘trigger’ law could revoke the program if federal assistance drops below 90%. https://t.co/FZ14ICQPUn

— WISH-TV News (@WISHNews8) December 11, 2024

Indiana is not often thought of as a low-cost healthcare state, yet its ACA marketplace offers some of the most affordable premiums in the Midwest. Part of the reason is moderate provider costs compared to neighboring Illinois and Ohio.

Indiana also benefits from multiple insurers operating across both urban and rural counties, which is unusual for many Midwestern states. Although Indiana resisted Medicaid expansion until 2015, the eventual adoption and hybrid “Healthy Indiana Plan” broadened coverage and helped stabilize private market premiums.

6. Michigan (~$404/month)

Michigan sits comfortably below the national average, thanks to Medicaid expansion in 2014 and a highly competitive marketplace. The state has a large base of unionized workers and employer-sponsored insurance, which reduces the number of high-risk individuals in the ACA market.

This keeps the exchange risk pool relatively balanced. Michigan also has a strong network of nonprofit hospital systems, which play a role in controlling costs.

7. Arizona (~$410/month)

Arizona’s premiums have steadily declined since the mid-2010s, when its marketplace faced insurer exits and high volatility. Today, however, major insurers such as Blue Cross Blue Shield and Ambetter have returned to the state.

According to ValuePenguin, Arizona’s premiums are now lower than the national average, reflecting greater competition and growing populations in metro areas like Phoenix and Tucson. Arizona also benefits from a younger demographic compared to older states like Vermont or West Virginia.

8. Nevada (~$414/month)

View this post on Instagram

Nevada operates a state-based exchange (Nevada Health Link) that has aggressively pursued reinsurance and cost-control measures. By 2025, the state will have successfully stabilized premiums by subsidizing insurers for catastrophic claims, similar to Maryland.

Nevada’s urban concentration in Las Vegas also means large, competitive hospital systems keep provider prices from skyrocketing. The combination of policy and market structure makes Nevada one of the cheapest states for ACA coverage.

9. Rhode Island (~$425/month)

Rhode Island is small in size but effective in healthcare regulation. The state closely monitors insurer filings to prevent unjustified premium hikes. Because of its small population, Rhode Island has been able to maintain tight control of risk pools and attract enough insurer participation to keep rates stable.

According to the Kaiser Family Foundation, Rhode Island also has one of the highest insured rates in the country, which spreads risk broadly and keeps premiums down.

10. Iowa (~$429/month)

Iowa’s premiums are among the lowest in the Midwest in 2025, despite being a rural state. This is partly because insurers like Wellmark returned to the marketplace after briefly exiting in 2017–2018, restoring competition.

The state also benefits from relatively lower hospital charges than South Dakota or Nebraska. While rural access challenges remain, Iowa’s market has avoided the extreme volatility seen in neighboring states.

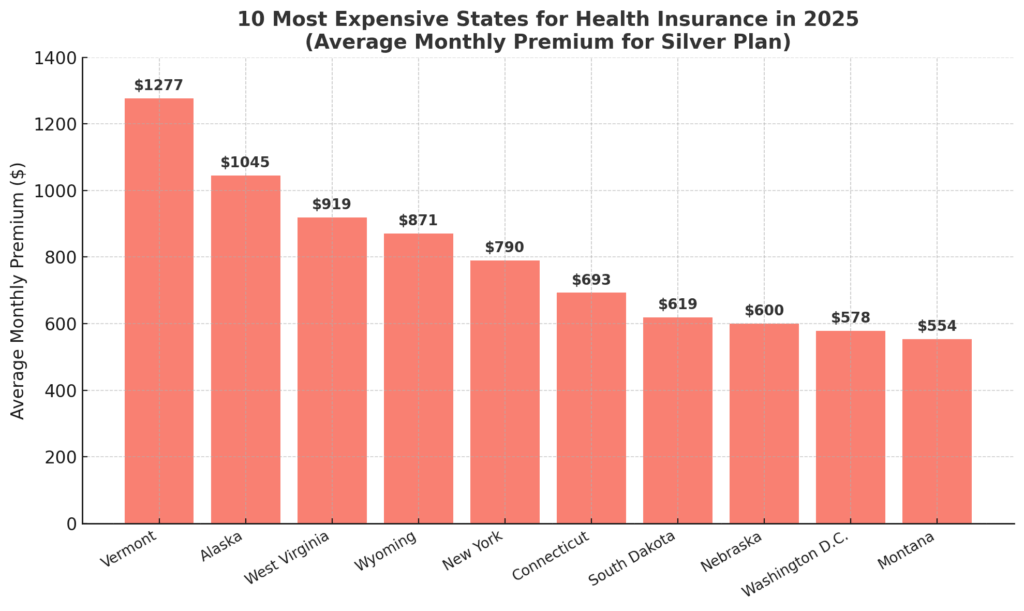

10 Most Expensive States for Health Insurance in 2025

On the other side of the spectrum, these states have the highest premiums in the country:

According to MoneyGeek, Vermont’s premiums are more than triple New Hampshire’s, even though they are neighboring states. This reflects how state policy, demographics, and local healthcare pricing can outweigh geography.

1. Vermont (~$1,277/month)

Vermont tops the list for the highest ACA premiums in 2025. Its small population, older demographics, and relatively unhealthy risk pool make premiums extremely high.

Vermont also requires richer minimum benefits compared to many other states, pushing average plan prices up. According to Investopedia, the combination of limited insurer participation and high provider costs creates a perfect storm for unaffordable premiums.

2. Alaska (~$1,045/month)

Alaska’s geography is the main driver of high costs. The state’s vast, rural layout makes healthcare delivery expensive, and transportation to medical facilities often adds significant overhead.

Although Alaska implemented a reinsurance program in 2017 that initially lowered premiums by 20%, it has not been enough to keep costs down. With limited competition – often just one insurer offering plans – premiums remain above $1,000 on average in 2025.

3. West Virginia (~$919/month)

West Virginia consistently ranks among the costliest states. The state’s high prevalence of chronic illnesses, an aging population, and one of the lowest insurer participation rates all contribute to premium spikes.

According to MoneyGeek, West Virginia’s average Silver premium nearly doubles the national average. Despite Medicaid expansion, the private insurance market has struggled because many healthier residents choose employer coverage, leaving the ACA pool smaller and riskier.

4. Wyoming (~$871/month)

Wyoming is often cited as one of the hardest states to insure. With a small population spread across rural counties, insurers face high risks and low enrollment numbers.

At times, Wyoming has had only a single insurer offering marketplace plans, eliminating competition entirely.

The lack of large hospital networks also pushes provider costs upward. As a result, its premiums are consistently among the nation’s highest.

5. New York (~$790/month)

@skynews #SkyNews spoke to people on the streets of #NewYork who were critical of the country’s #healthcare ♬ original sound – Sky News

New York is unique because, while it has many insurers, its premiums are inflated by high provider costs and mandatory state coverage rules. The state requires plans to cover more services than the federal minimum, which improves benefits but raises prices.

Additionally, the high cost of living and healthcare in New York City drives up statewide averages. However, New York also has the Essential Plan, a state subsidy program that provides very low-cost coverage to qualifying low-income residents, partially offsetting the burden.

6. Connecticut (~$693/month)

Connecticut’s premiums are high compared to nearby Massachusetts and Rhode Island. Wealth and high provider charges play a role. Large hospital systems dominate the state, and consolidation reduces price competition.

Connecticut has tried to mitigate this with state subsidies, but average Silver premiums still rank among the nation’s most expensive. According to PeopleKeep, Connecticut remains in the top tier of costly states year after year.

7. South Dakota (~$619/month)

South Dakota illustrates how rural healthcare can drive prices higher. With limited insurer participation and high reliance on a small number of hospital systems, premiums are inflated.

The state’s refusal to expand Medicaid until 2023 also contributed to years of instability in its ACA marketplace, with premiums remaining higher than in neighboring Minnesota or Iowa.

8. Nebraska (~$600/month)

Nebraska suffers from many of the same challenges as South Dakota: rural demographics, insurer exits, and limited provider options. Although Nebraska expanded Medicaid in 2020, it did so late, and premiums have remained higher than in states with longer-running expansions.

According to ValuePenguin, Nebraska’s benchmark Silver premiums have consistently exceeded $550 since 2020.

9. Washington, D.C. (~$578/month)

The nation’s capital may not seem like a high-cost insurance market given its urban setting, but D.C. has unusually high hospital prices compared to other metro areas. The small size of the marketplace also means less competition, with only a handful of insurers offering plans.

While subsidies and Medicaid cover a large portion of residents, unsubsidized enrollees face some of the steepest premiums in the Mid-Atlantic region.

10. Montana (~$554/month)

Montana rounds out the list of the top 10 most expensive states. Like Wyoming and South Dakota, its rural geography creates insurance challenges. Provider consolidation has further reduced competition, allowing hospital systems to negotiate higher reimbursement rates with insurers.

This drives up premiums, even though Montana’s overall cost of living is not particularly high.

Regional Comparison

| Region | Cheaper States | More Expensive States |

| Northeast | New Hampshire, Maryland, Rhode Island | Vermont, New York |

| Midwest | Minnesota, Indiana, Michigan, Iowa | South Dakota, Nebraska |

| South | Virginia | West Virginia |

| West | Arizona, Nevada | Alaska, Wyoming, Montana, California (mid-range) |

This regional snapshot highlights that health insurance affordability in 2025 does not follow simple geographic lines. For example, the Northeast contains both the cheapest state (New Hampshire) and the most expensive (Vermont), despite being neighbors.

In the Midwest, strong Medicaid expansion and nonprofit insurer networks helped Minnesota and Michigan keep rates low, while rural states like South Dakota and Nebraska face higher premiums due to weaker competition. In the South, Virginia’s newly built state exchange has lowered costs, yet West.

Virginia continues to struggle with an older population and limited insurer options. The West is perhaps the most polarized region, with Arizona and Nevada showing stable, competitive markets, while Alaska, Wyoming, and Montana see soaring costs tied to geography and limited provider access.

These contrasts underline that state-level policies, market structure, and demographics matter more than simple regional identity when it comes to insurance pricing.

Why Are Premiums So Different?

- Healthcare costs in each state – According to ValuePenguin, hospital prices and physician charges vary significantly, making Vermont and Alaska more expensive than states like Minnesota.

- Competition among insurers – When only one or two insurers operate in a state, premiums rise. Wyoming and West Virginia are prime examples.

- State policies and reinsurance – Maryland and Nevada introduced state reinsurance programs that directly reduced premiums by covering high-cost claims.

- Demographics – States with older, sicker populations (Vermont, West Virginia) pay more.

- Medicaid expansion – According to the Kaiser Family Foundation, states that expanded Medicaid saw lower premiums overall because more low-income residents moved out of the private market.

The Role of Subsidies in 2025

Premiums listed above are before federal subsidies. Under the Inflation Reduction Act, ACA subsidies remain expanded through at least 2025. According to the Department of Health and Human Services:

- About 4 in 5 enrollees qualify for subsidies.

- Many households earning under 250% of the federal poverty level pay less than $50/month after tax credits.

- Even in Vermont, some residents still pay under $100 with subsidies.

This means the raw state averages matter most for those who do not qualify for large subsidies (e.g., middle-income households).

Additional Factors Related to Affordability

- Employer Coverage vs. Marketplace – In Hawaii, premiums are very low because state law caps what employers can charge workers.

- Rural Access – States with few hospitals and high transport costs, like Alaska and Montana, often face higher premiums.

- State Healthcare Initiatives – Oregon recently created a “public option” style program to control costs, while California established a healthcare affordability office.

- Preventive Care – Expanding coverage for mental health, maternity, and telehealth can also stabilize costs over time.

Methodology

This article was created using 2024–2025 ACA Marketplace data on Silver benchmark plan premiums for a 40-year-old nonsmoker, as reported by sources including PeopleKeep, MoneyGeek, ValuePenguin, and the Kaiser Family Foundation.

Premium figures were cross-checked across multiple insurance analyses to ensure consistency and accuracy. State-by-state notes were developed by reviewing policy reports on Medicaid expansion, reinsurance programs, and insurer participation.

Regional insights were based on comparing average premiums with demographic and policy contexts. All statistics and references are drawn from publicly available, reputable resources published between late 2024 and early 2025.

Conclusion

In 2025, the difference between the cheapest and most expensive states for health insurance is dramatic: New Hampshire at $325/month vs. Vermont at $1,277/month. That means a family of four could save more than $35,000 per year simply by living in one state rather than another.

These differences are shaped by competition, demographics, Medicaid expansion, and state-level policies. While subsidies help many households reduce costs, the underlying premium gap shows how uneven the U.S. healthcare market remains.

Immigrant communities often face additional barriers such as limited eligibility, language obstacles, and a lack of legal support, which can make access to affordable coverage even more difficult.

For individuals and families, the key takeaway is that even in expensive states, tools like subsidies, reinsurance programs, and careful plan selection can make coverage more manageable. But from a policy perspective, the U.S. still has a long road ahead in achieving consistent and equitable affordability across states.