Music streaming platforms now run the U.S. music business. What used to be an add on next to radio and downloads has become the main way people play songs, build playlists, and follow new releases.

In 2025, about 79% of Americans age 12 and up listen to online audio in a typical month. Paid music streaming subscriptions also sit at a huge level, around 100 million in the United States.

The money points the same direction. Streaming accounts for about 84% of U.S. recorded music revenue, so record labels, managers, and artists pay close attention to app behavior. Playlist placement, algorithmic recommendations, and monthly listener counts shape discovery and earnings, while users compare platforms on song catalog, sound quality, pricing tiers, family plans, and how well the app works on phones, cars, and smart speakers.

Spotify remains the top music streaming platform in the U.S., reaching 35% of Americans each month. YouTube Music keeps rising, Apple Music stays strong with iPhone users, Amazon Music leans on Prime and Alexa, and Pandora holds a radio style lane for people who want lean back listening.

The insights about the most popular music streaming platforms in the US are from Edison Research’s Infinite Dial 2025 study, one of the most trusted reports on digital media.

The sections below break down the leading music streaming platforms in the U.S., compare monthly reach and primary use, and show what current listener trends suggest about the next stage of the streaming market.

Streaming in Numbers

| % of Americans age 12+ who listened to online audio in the last month (2025) | 79% (about 228M people) |

| % of Americans age 12+ who listened to online audio in the last week (2025) | 73% (about 210M people) |

| Paid music streaming subscriptions in the US (2024) | 100M+ |

| Recorded music industry revenue, retail value (US, 2024) | $17.7B |

| Streaming revenue, retail value (US, 2024) | $14.9B |

| Share of recorded music revenue from streaming (US, 2024) | 84% |

| Physical formats share of revenue (US, 2024) | about 11% (about $2.0B) |

About 79% of Americans listen in a typical month, and 73% listen in a typical week. Paid music subscriptions have passed 100 million, showing how much listening now happens on paid streaming services. Streaming brings in about 84% of recorded music revenue, while vinyl and CDs make up a much smaller share.

Overall Rankings by Monthly Usage (US, 2025)

| Rank | Music Streaming Platform | Monthly Reach (% of Americans age 12+) |

| 1 | Spotify | 35% |

| 2 | YouTube Music | 28% |

| 3 | Pandora | 17% |

| 4 | Apple Music | 16% |

| 5 | Amazon Music | 15% |

| 6 | iHeartRadio | 9% |

| 7 | SoundCloud | 6% |

1. Spotify is Still the Leader in the Market of Music Streaming

The most popular music streaming platform remains Spotify, and the gap still matters.

Spotify reaches 35% of Americans age 12+ in a typical month, showing broad monthly usage, not just a niche fan base. It also ranks first as the primary app: among online audio listeners, 34% say Spotify gets used most often, which signals habitual, day-to-day listening rather than occasional streaming.

| Number of listeners each month (12+) | 35% |

| “Used most often” (primary choice) | 34% |

| Global monthly active users | 696M |

| Global paying subscribers | 276M |

| Core features | On-demand music, podcasts, and audiobooks |

Spotify keeps growing because the app makes music streaming discovery easy. Recommendations, personalized mixes, and playlist tools help people find songs fast, save them, and keep listening without searching every time.

Key features drive repeat use. Discover Weekly, Daily Mix, and Wrapped push users back into the platform and keep Spotify at the center of daily music streaming habits.

Spotify also competes by bundling more than songs in one place. Users can switch between on-demand music, podcasts, and audiobooks inside the same music streaming platform. The company has also pushed exclusive podcast deals, which help keep listening time inside Spotify instead of shifting to rival apps.

Scale gives Spotify an advantage in the streaming market. With nearly 700 million monthly active users worldwide and more than 276 million paying subscribers, it can invest in new features, creator tools, and personalized recommendation systems.

That reach helps Spotify stay the default music streaming app for many U.S. listeners.

2. YouTube Music is the Fastest Riser

In the U.S. music streaming market, YouTube Music ranks second and keeps gaining ground.

The platform reaches 28% of Americans age 12+ in a typical month. It also shows rising primary use: among online audio listeners, 21% say YouTube Music is the service they use most often, which signals growing daily reliance rather than occasional plays.

| Number of listeners each month(12+) | 28% |

| “Used most often” share | 21% |

| Global subscribers (Premium + Music) | 125M (2025, incl. trials) |

| Core strengths | Video-music integration, live performances, remixes |

The big advantage comes from tight pairing with regular YouTube. Switching between a music video, a live set, a remix, and an audio-only track takes one tap, so music streaming feels like an extension of the same platform people already use all day.

That setup is a natural fit for younger listeners, who often discover songs through clips, creators, and trends before saving them to playlists.

Scale is turning into muscle. With more than 125 million Premium and Music subscribers worldwide, YouTube Music has become the clearest challenger to Spotify, especially for listeners who want both audio and video in one place.

Travel habits add another layer. Many users listen on the move or outside the US, where catalog rights can shift by country. For that reason, some subscribers lean on tools like an iphone vpn to keep playlists working and maintain access across borders.

All of that makes YouTube Music a go-to option for mobile-first audiences who want music streaming that follows them anywhere, in whatever format they feel like watching or hearing next.

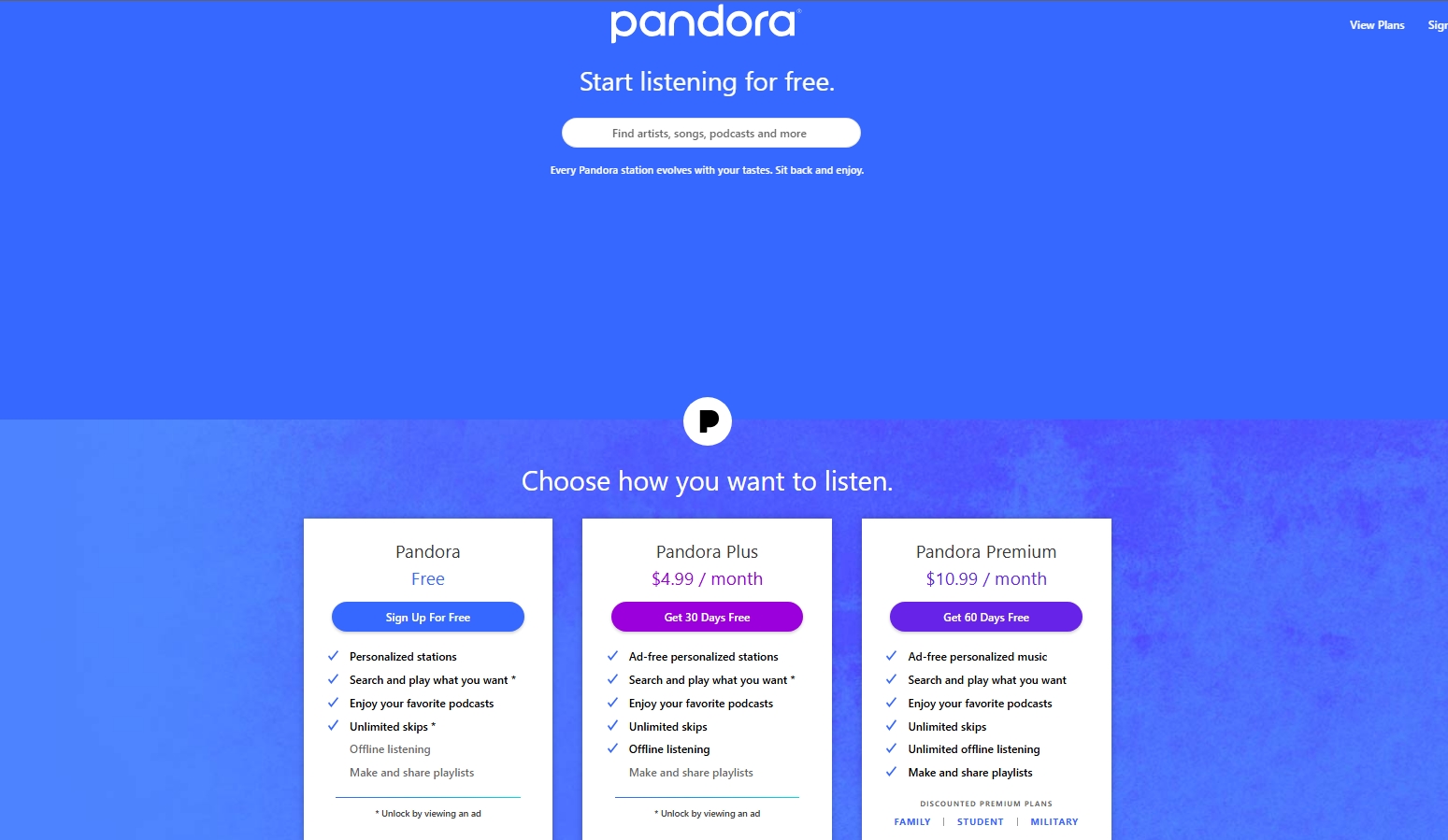

3. Pandora as The Radio Veteran

Pandora somehow survived the competition led by Spotify and YouTube Music.

The online radio platform reaches 17% of Americans age 12+ in a typical month, and 13% of online audio listeners say it is the service they use most often.

That mix of steady reach and strong primary use keeps it in the top tier for audience size, powered by listeners who prefer a simple, radio-style streaming experience.

| US monthly reach (12+) | 17% |

| “Used most often” share | 13% |

| Estimated monthly active users | ~40M |

| Core strengths | Personalized radio, passive listening, mostly used in cars |

Pandora works best for lean-back music streaming. People fire it up in the car, at work, or while doing chores, then let the stations run without thinking about every next song.

The radio-first design still feels smoother than many on-demand apps for anyone who wants a soundtrack, not a search box.

Algorithmic stations remain the heart of the product, and they still satisfy listeners who like discovery without effort. Growth has cooled, though. On-demand platforms win over users who want full control, bigger ecosystems, and social playlist culture.

Pandora keeps a loyal lane, but the wider music streaming market is steadily shifting toward services built around choice first and radio second.

4. Apple Music: Premium but Niche

@carterpcs Does Apple Music REALLY sound better than spotify? #carterpcs #tech #techtok #techfacts #spotify #applemusic ♬ long version(1173620) – nightbird_bgm

Apple Music stays one of the biggest names in music streaming, especially on the paid side of the market.

In the US, the service reaches 16% of Americans age 12+ each month. Among people who already listen to online audio, 13% call Apple Music their primary platform, showing a solid core audience even without the raw scale of Spotify or YouTube Music.

| US monthly reach (12+) | 16% |

| “Used most often” share | 13% |

| Ecosystem strength | Deep integration with iOS, HomePod, Apple Watch |

| Features | Lossless, spatial audio, curated editorial playlists |

Apple Music leans into premium music streaming. Tight connections with Apple devices make it feel native for millions of listeners, while higher-end audio options like lossless and spatial formats give it extra pull for people who care about sound.

Editorial playlists and radio-style shows also keep the service feeling human-curated instead of purely algorithm-driven.

A paid-only model caps total reach, since there is no free tier to pull in casual users. The tradeoff is a steadier base of subscribers who choose Apple Music for quality, polish, and a clean listening setup.

For many iPhone users and audiophiles, that mix keeps Apple Music near the top of the music streaming shortlist year after year.

5. Amazon Music – Built on Prime

@jessicanturner THREE REASONS TO TRY AMAZON MUSIC UNLIMITED #AmazonMusicPartner ♬ original sound – Jessica Turner

Amazon Music holds a solid mid-pack spot in US music streaming.

The service reaches 15% of Americans age 12+ in a typical month, but only 8% say it is the platform they use most often. Reach is strong, primary loyalty is softer, which says a lot about how people end up on Amazon Music.

Bundling does most of the heavy lifting. Amazon Prime includes a built-in music tier, so tens of millions of households get access without signing up for another paid service.

That easy entry point keeps Amazon Music in regular rotation even for listeners who do not think of it as their main app.

| US monthly reach (12+) | 15% |

| “Used most often” share | 8% |

| Bundling advantage | Prime members get limited free access |

| Features | On-demand, Alexa integration, Echo smart speaker tie-in |

Amazon Music fits everyday, practical music streaming. Plenty of users land there because it is already included, works smoothly with Alexa, and feels frictionless on Echo speakers, cars, and TVs.

For hardcore music fans, it may not be the first pick, but for many Prime households, it lands in the sweet spot of convenience, price, and “good enough” catalog depth.

That combination keeps Amazon Music relevant in 2025 even without leading the race.

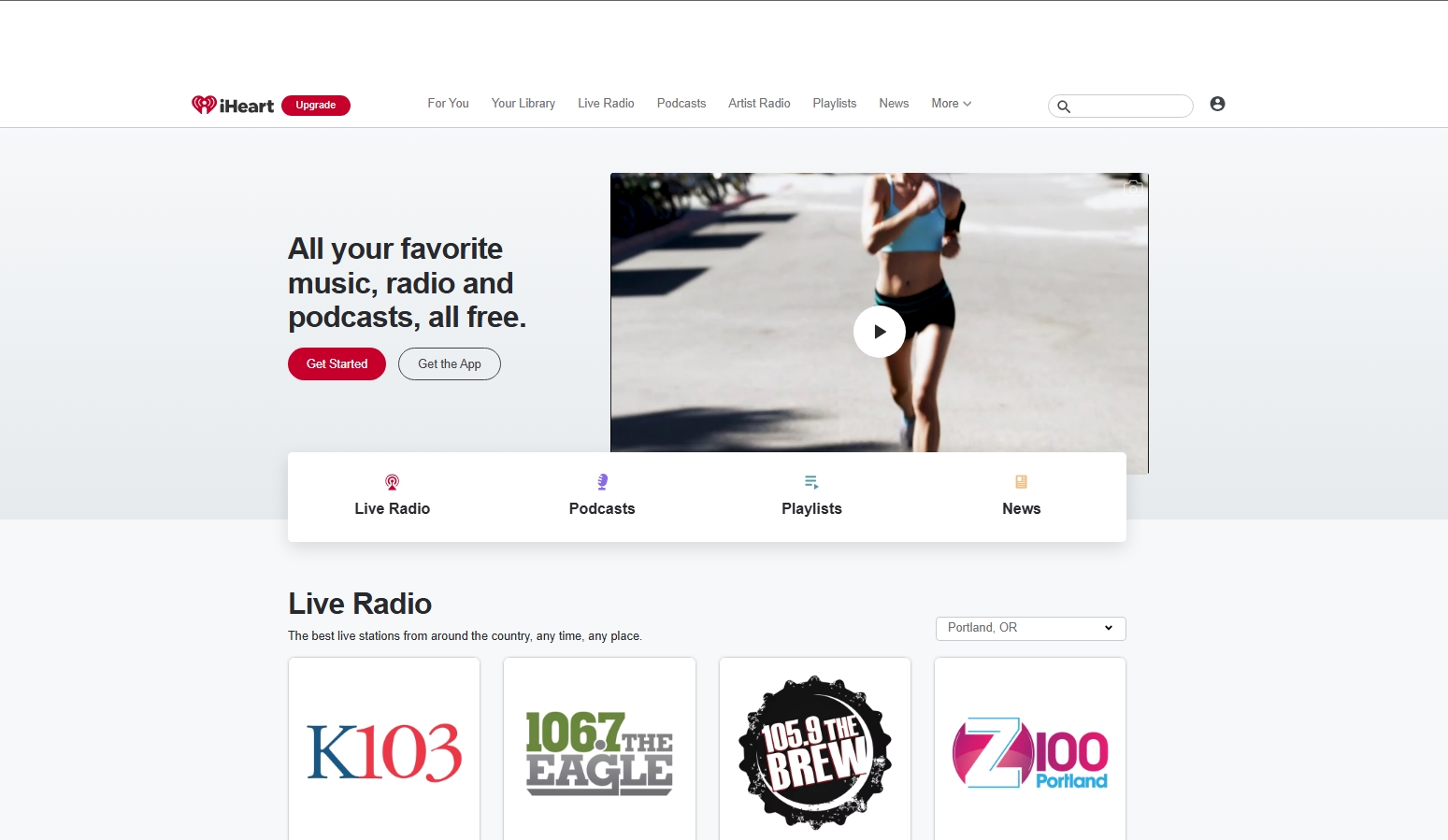

6. iHeartRadio – Where Radio Meets Streaming

iHeartRadio sits in a different lane from the big on-demand music streaming apps. About 9% of Americans age 12+ use it in a typical month, and roughly 5% of online-audio listeners say it is the service they use most often.

That keeps it firmly in the mix, even if it is not chasing Spotify-style dominance.

| US monthly reach (12+) | 9% |

| “Used most often” share | 5% |

| Core strengths | Local radio access, branded festivals, and podcast integration |

iHeartRadio works best for listeners who still want radio, just delivered through music streaming habits. The app brings thousands of live local stations into one place, then layers in curated channels and a big podcast catalog.

Instead of forcing people to build playlists or hunt for new artists, it offers a familiar lean-back experience with the convenience of streaming.

The main value is cultural and practical: keeping broadcast radio easy to reach in a world where most listening happens online.

For commuters, sports fans, talk-radio loyalists, and anyone tied to local stations, iHeartRadio remains a useful bridge between old-school radio and modern music streaming.

7. SoundCloud – Niche but Culturally Vital

SoundCloud stays a smaller player in the U.S. streaming market, with about 6% monthly reach. The audience still matters because the platform works differently from the big catalog apps. SoundCloud runs on uploads from creators, so users hear new tracks, rough demos, remixes, and DJ sets that often do not show up on Spotify or Apple Music right away.

A lot of the culture comes from how people use it. Artists post music the moment it is finished. Listeners leave comments on exact moments in a track. Producers trade feedback, repost each other, and build small scenes around rap, electronic, and indie.

SoundCloud also pays some artists differently. Fan-powered royalties send subscription money to the artists a listener actually plays, rather than pooling it and splitting it by total streams.

New features in 2025, including Buzzing Playlists, aim to surface tracks picking up momentum with listeners.

| US monthly reach (12+) | 6% |

| “Used most often.” | Not broken out separately |

| Core audience | Indie fans, electronic/hip-hop communities, DIY creators |

| Strengths | Remixes, early access to emerging artists, grassroots feel |

Reach may be modest, but influence punches way above its weight. Several of the last decade’s biggest breakout names first built momentum on SoundCloud, including Post Malone and Chance the Rapper, along with a long list of underground stars who later jumped to mainstream platforms.

For anyone who wants music streaming to feel alive, a little messy, and a step ahead of the charts, SoundCloud remains the place where tomorrow shows up early.

What the Numbers Tell Us

- Spotify still sets the pace. The service leads both in monthly reach and in “used most often” share, which means Spotify is not only big, it is sticky. Many listeners treat it as the default place to search, save, and return to, making it the main hub of US music streaming.

- YouTube Music is the main growth story. A monthly reach of 28% and a fast-rising primary share point point to momentum that goes beyond casual use. Video-first discovery, live performances, remixes, and direct ties to regular YouTube help YouTube Music pull listeners who already live inside that ecosystem.

- Lean-back radio platforms are holding a lane, but aging out. Pandora and iHeartRadio still show meaningful reach, largely tied to cars, workplaces, and talk or local radio habits. Growth stays limited because younger listeners tend to want on-demand control, playlists, and social discovery rather than “press play and let it run” formats.

- Ecosystems keep Apple Music and Amazon Music competitive. Apple Music stays strongest where iOS devices and premium audio features shape daily listening, while Amazon Music benefits from Prime bundling and Alexa or Echo habits. Both services win more on convenience and device life than on pure word-of-mouth music streaming hype.

- SoundCloud proves influence is not only about size. Even with single-digit reach, SoundCloud remains a cultural pipeline for new artists, remixes, and underground scenes. Smaller platforms can matter a lot when they serve a clear community and offer features that the main services do not.

Taken together, the rankings show a US music streaming market that is top-heavy but not frozen. Leaders stay strong, challengers can rise fast, and legacy formats survive when they solve a specific listening need. For artists, labels, and brands, platform choice shapes discovery, fan growth, and revenue potential.

Music platforms do more than connect fans and artists; they also open up a wide range of digital platforms, earning avenues that extend far beyond streaming alone.

Conclusion

In 2025, the US music landscape is clear: streaming is the center of the industry, and within streaming, Spotify sets the pace.

YouTube Music is closing in quickly, Pandora holds on to radio fans, and Apple and Amazon carve out loyal bases tied to their ecosystems.

Meanwhile, iHeart and SoundCloud continue to serve important but smaller audiences.

For everyday listeners, this means one thing: no matter what kind of music fan you are,playlist-driven, radio-loyal, indie-focused, or video-first, there’s a major platform competing to serve your needs.