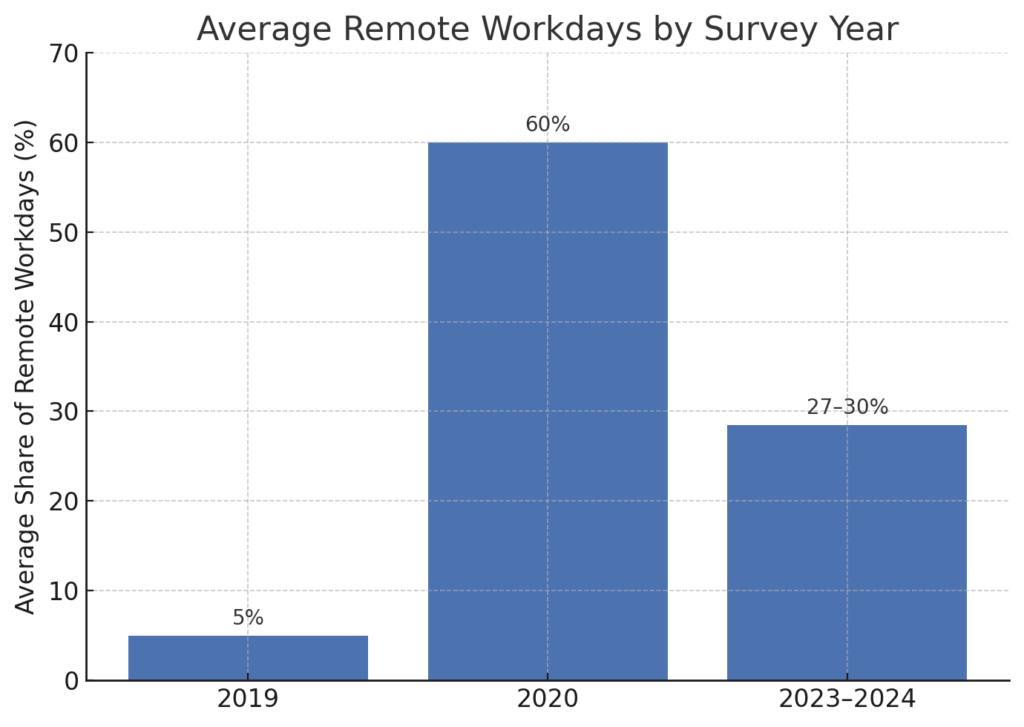

The post-pandemic American workplace is now permanently altered. What began as a temporary health emergency response has evolved into a structural shift in the geography of work.

Take the case of Tucson, Arizona, a classic example of a mid-sized city with a growing tech and defense sector. Pre-pandemic, only 4.9% of the workforce worked remotely.

By 2022, that number had grown to over 25%, thanks to companies like Raytheon Technologies adopting hybrid models and a growing number of tech workers employed remotely by firms in Phoenix or California, according to the BLS.

Similarly, Boise, Idaho, experienced a remote work boom that supported local economic expansion. The city, already known for its relatively low cost of living and high quality of life, became a hotspot for remote tech workers, contributing to increased housing demand, retail activity, and a noticeable uptick in economic diversity.

These examples underscore a key theme: mid-sized cities have become landing zones for remote professionals, offering a balance between affordability, livability, and economic opportunity.

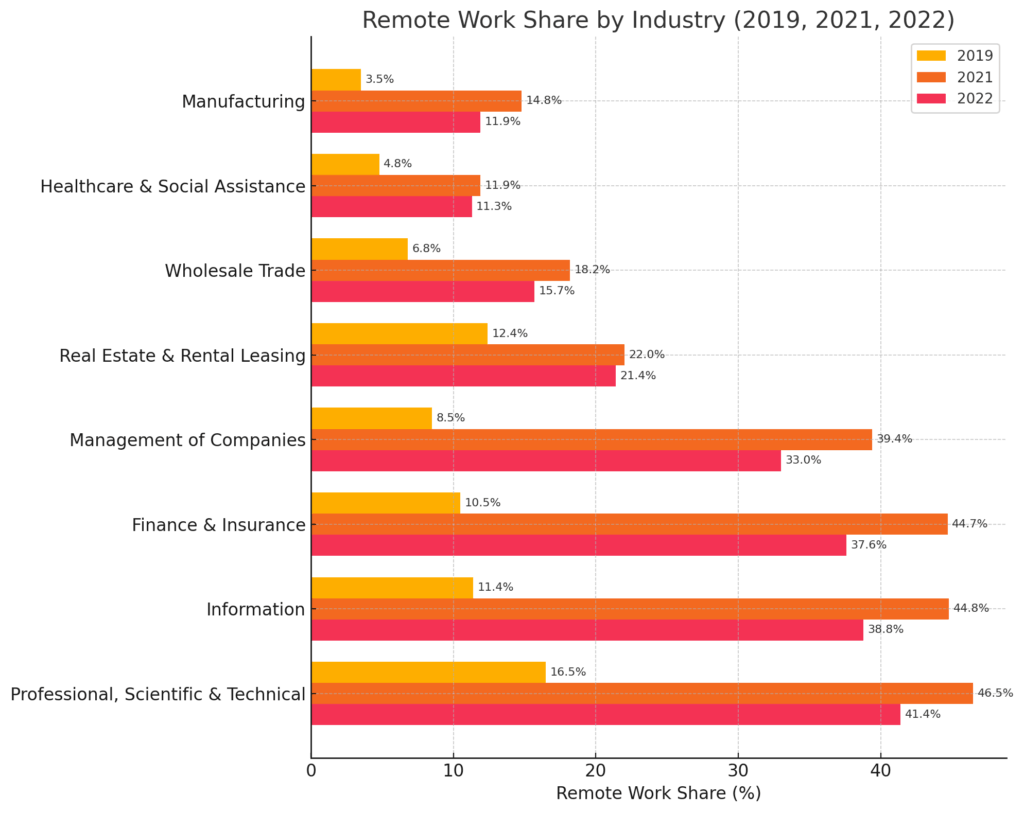

Remote Work Share by Industry

To understand how remote work impacts mid-sized cities, it’s essential to explore which industries are driving this transformation.

Mid-sized cities like Des Moines, Iowa, and Wichita, Kansas, typically have lower concentrations of finance and information-sector jobs than large metros like New York or San Francisco.

However, cities like Raleigh, North Carolina, with a strong biotech and IT presence, or Salt Lake City, Utah, with its booming fintech scene, mirror the profile of larger metros and have experienced more pronounced remote work effects.

In Des Moines, a regional hub for insurance and financial services, remote work has remained above 30%, leading to population shifts into suburbs like West Des Moines and Ankeny.

This industry-based variation explains why some mid-sized cities are feeling the Donut Effect more acutely—those with high shares of remote-capable industries see greater decentralization.

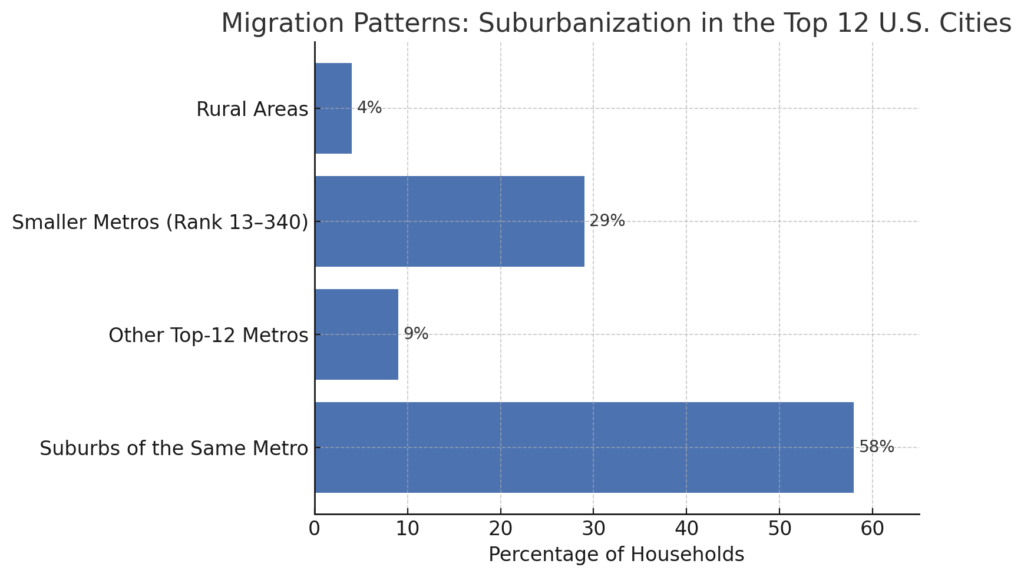

Suburbanization in Numbers: Migration Patterns in Focus

According to the USPS National Change of Address data (April 2017–June 2023), the majority of moves from downtown zones of large cities are not cross-country but cross-suburban. Let’s break this down further.

Why Are Suburbs Gaining?

View this post on Instagram

One reason for the intra-metro suburban shift is the persistence of hybrid work, which binds employees loosely to their offices.

A worker in Charlotte, North Carolina, for example, might need to commute just 2–3 times a week. That allows relocation from Uptown Charlotte to Huntersville or Concord, where housing is more affordable, schools may be better, and quality of life is perceived as higher.

In Columbus, Ohio, a similar dynamic plays out. Suburbs like Dublin and Westerville have seen consistent home sales, while downtown apartment occupancy has stagnated, despite urban renewal efforts.

This trend is driven by young professionals and families taking advantage of larger homes, lower prices per square foot, and the freedom to design home offices.

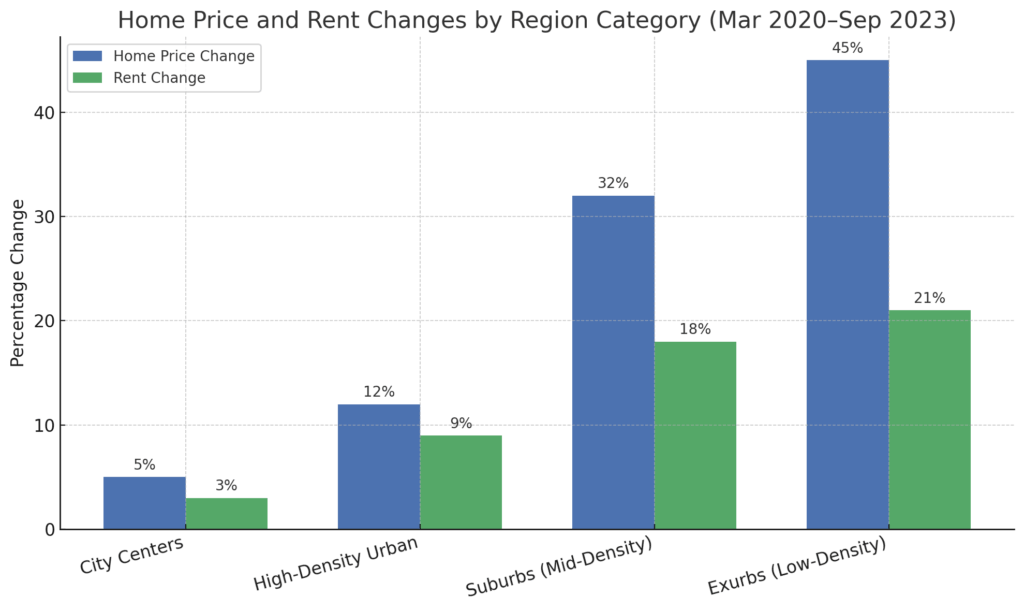

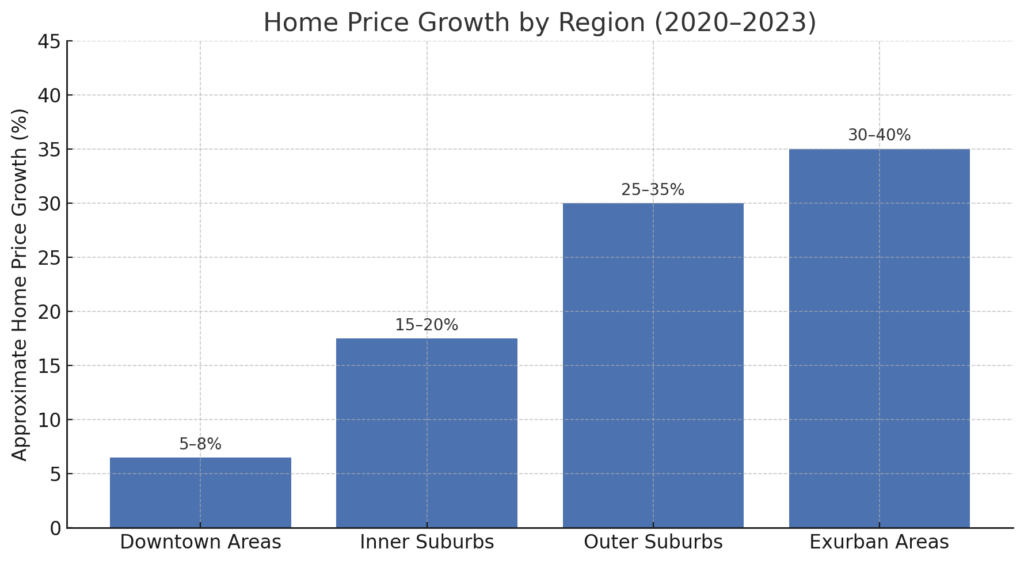

Real Estate Divergence: Suburbs Surge While City Centers Stabilize

The housing market offers clear, quantifiable signals of urban restructuring. Zillow’s Home Value Index and Observed Rent Index provide vital insight into shifting demand. Here’s how it breaks down in the top 12 US metros.

| Metro Area | Home Price Change | Rent Change |

| New York, NY | +12% | +9% |

| Los Angeles, CA | +15% | +10% |

| Chicago, IL | +10% | +7% |

| Dallas, TX | +20% | +12% |

| Houston, TX | +18% | +11% |

| Washington, D.C. | +13% | +8% |

| Miami, FL | +25% | +15% |

| Philadelphia, PA | +11% | +7% |

| Atlanta, GA | +22% | +13% |

| Boston, MA | +14% | +9% |

| San Francisco, CA | +9% | +5% |

| Phoenix, AZ | +28% | +16% |

What About Mid-Sized Cities?

While mid-sized metros do not show as sharp a divergence, the pattern holds. In Grand Rapids, Michigan, suburban areas like Kentwood and Walker saw double-digit price growth compared to the city’s central neighborhoods.

In Spokane, Washington, suburban neighborhoods like Mead and Liberty Lake have seen faster home appreciation and fewer days on market than central zip codes.

Why?

- Remote work increased demand for space and privacy

- Lower commute burdens allow workers to move further from downtowns

- Flexible schedules create new lifestyle preferences, favoring neighborhoods with green space, better schools, and lower noise levels

Transportation and Commuting: Shifting Patterns in Mid-Sized Cities

One of the most profound shifts observed in the wake of remote and hybrid work has been in transportation patterns. The Inrix and GPS data provide a lens into how people’s movement habits have evolved:

| Metric | Pre-Pandemic (2019) | 2023 |

| Vehicle Trips (Peak Hours) | Baseline (100%) | -20% |

| Rail Transit Ridership | Baseline (100%) | -30% |

| Average Driving Speed | Baseline (0%) | +10% |

In mid-sized cities, these changes, though less dramatic than in megacities like New York, have still made an impact. Charlotte, NC, for instance, saw traffic on key arteries like Interstate 77 and Independence Boulevard decrease during the pandemic, with partial recovery in 2023 but still below pre-pandemic congestion levels.

Des Moines, IA, observed smoother flow along I-235, with a noticeable drop in peak-hour backups.

A lot of the discourse surrounding rapid transit systems, especially in North America, is that some cities are “too small” for a comprehensive transit system or a metro, but Rennes – a French city with less than half a million residents, disagrees.https://t.co/jith1363ww pic.twitter.com/mpjvh0oTYs

— Reece (@RM_Transit) August 29, 2023

Public transit systems in mid-sized cities are often less robust than those in major metros, but are crucial for workers without private vehicles. Cities like Salt Lake City, UT, and Madison, WI, reported declines in bus and light rail usage, with ridership down by about 25-30% compared to pre-pandemic levels, according to GAO.

However, these systems have proven more adaptable, introducing flexible routes and on-demand microtransit options.

Mid-sized cities have benefited from less traffic congestion, but their public transit systems face funding and operational challenges, requiring innovation to align with new travel behaviors.

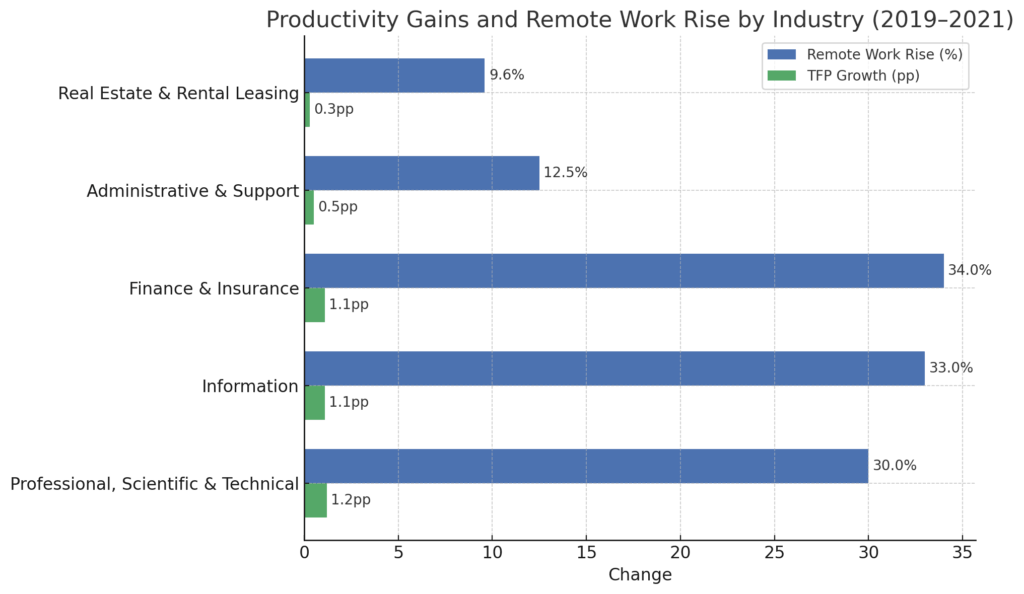

Productivity Gains and Economic Resilience in Mid-Sized Cities

The rise in remote work has been linked to increased total factor productivity (TFP) in several sectors. Here’s a more detailed look at industry-level data:

While major urban hubs saw the bulk of these gains, mid-sized cities with strong representations in professional services and tech (e.g., Raleigh-Durham, NC; Salt Lake City, UT; Chattanooga, TN) have also enjoyed notable productivity improvements.

Interestingly, despite these productivity gains, worker compensation hasn’t kept pace.

| Change per 1% Remote Work Increase | Unit Cost Reduction |

| Unit Labor Costs | -0.1% |

| Unit Office Costs | -0.4% |

| Unit Nonlabor Costs (Capital, Energy) | -0.2% to -0.4% |

This gap points to employer-driven cost savings through reduced office space, energy use, and capital expenditures, without proportionate wage growth.

In cities like Madison, WI, which hosts major employers like Epic Systems, hybrid work has allowed firms to expand operations without increasing physical office footprints, enhancing operational efficiency. Similarly, Boise, ID, has seen remote-friendly startups and businesses scaling without significant office investment.

Public Policy and Urban Planning Responses

Mid-sized cities are responding to these trends with creative policies and infrastructure investments to retain vibrancy in urban cores and support hybrid work lifestyles.

Case Study: Madison, Wisconsin

- Downtown Revitalization Grants: Incentives for converting vacant office space into residential units and mixed-use developments.

- Expanded Broadband Access: Investment in high-speed internet to support remote work from all neighborhoods.

- Public Transit Innovation: Launch of on-demand shuttles and flexible bus routes.

Case Study: Chattanooga, Tennessee

- Gig-Speed Internet Infrastructure: Chattanooga’s EPB has enabled seamless remote work with citywide fiber connectivity.

- Innovation Districts: Efforts to foster a creative economy with hybrid workspaces, co-working hubs, and community collaboration zones.

- Affordable Housing Initiatives: Focus on retaining workers downtown by offering incentives for affordable residential developments.

| City | Key Initiatives |

| Madison, WI | Broadband expansion, flexible zoning, microtransit |

| Chattanooga, TN | Gig-speed internet, innovation zones, housing incentives |

| Salt Lake City, UT | Suburban office hubs, mixed-use zoning, transit-oriented development |

| Raleigh, NC | Downtown revitalization, hybrid-friendly public spaces |

A Closer Look at Suburban and Exurban Growth

The data consistently shows that hybrid work has fueled suburban growth, especially in mid-sized cities where housing affordability and quality of life are already attractive.

In Columbus, OH, areas like Hilliard and Grove City have seen double-digit home price growth, while the downtown has remained relatively flat.

Omaha, NE, another example of a resilient mid-sized city, has witnessed growth in suburbs like Papillion and La Vista, supported by hybrid work trends.

Resilience and Future Outlook for Mid-Sized Cities

Is the remote work trend here to stay? The data from Statista and trends suggest that hybrid work is now embedded in corporate strategies.

Mid-sized cities are poised to benefit from this new equilibrium:

- Reduced congestion and better air quality

- More flexible urban cores with mixed-use developments

- Sustained suburban growth

- Opportunities for businesses to attract remote talent without high real estate costs

However, challenges remain:

- Public transit systems must adapt to fluctuating demand.

- City budgets face pressure from declining office-based tax revenues.

- Affordable housing in suburbs and exurbs is becoming a concern.

Conclusion

The rise of remote and hybrid work has undeniably reshaped mid-sized American cities. While large metros grapple with severe Donut Effects, mid-sized cities are experiencing a more balanced transition.

Key takeaways include:

- Economic activity has shifted outward, but mid-sized downtowns remain resilient.

- Real estate markets are stabilizing, with strong suburban demand but urban cores adapting through mixed-use developments.

- Productivity gains are evident, though workers have yet to fully benefit from wage increases.

- Public policy innovations in broadband, housing, and transit are key to sustaining growth.

For mid-sized cities, the future is not one of decline but transformation. By embracing hybrid work models, supporting inclusive growth, and rethinking urban design, these cities can emerge more livable, adaptable, and resilient than ever before.